Earlier this year, we reported on the status of U.S timberland transactions year-to-date in 2021. Based on the current trend of timberland transaction activity at the time, the forecast for 2021 seemed promising. How has this prediction held up in the intervening 3 months? Should we be honing our Miss Cleo impressions in case this forestry gig doesn’t work out?

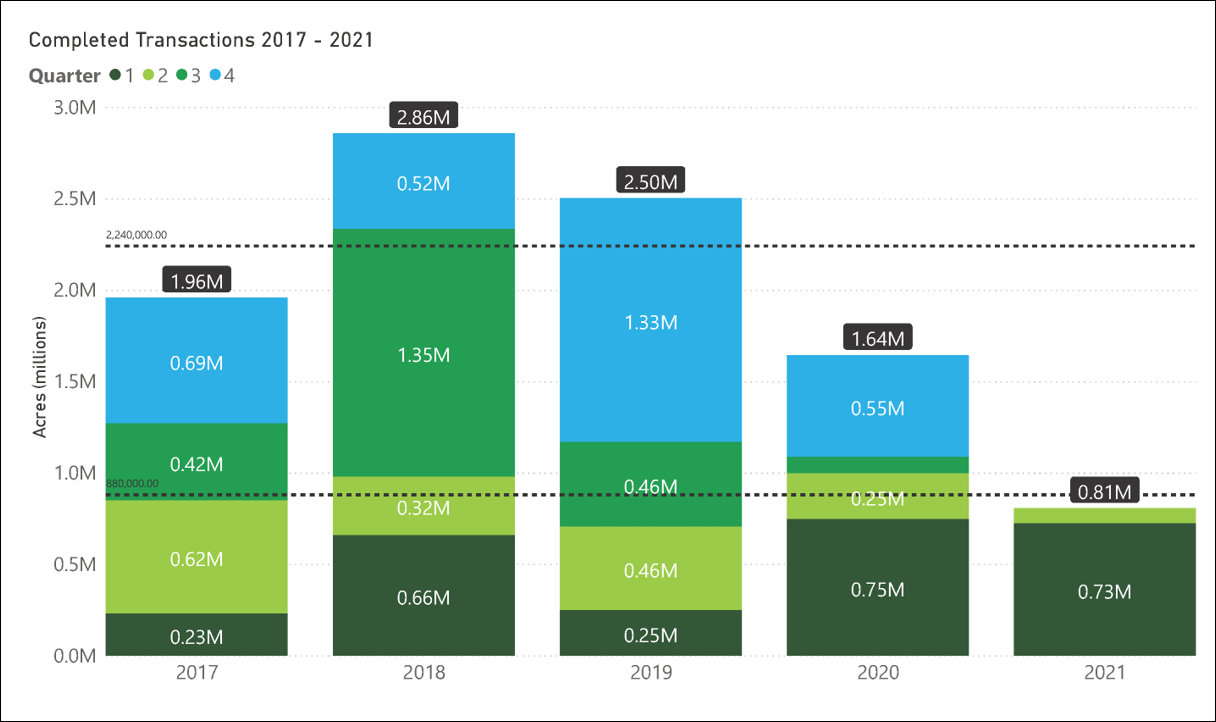

If we take a look at timberland transaction activity in the past four years, we averaged around 2.2 million acres per year of completed transactions. Over the same period, we averaged about 880,000 acres of completed transactions by end of Q2 (see figure below). Putting this into context, we are marginally below the four-year average with just over 800,000 acres of completed transactions year-to-date. Although, given that we have yet to complete Q2 and the availability of completed transaction data tends to lag, we generally appear on track for a normal year in terms of completed timberland transactions.

The notable transaction that occurred since our last update was Weyerhaeuser’s acquisition of 69,200 acres of Greif Packaging subsidiary Soterra timberland for an estimated $149 million (Good Greif!)[1]. After this closing was announced, Weyerhaeuser simultaneously announced they reached a preliminary agreement to sell 145,000 acres in Washington to Hampton Affiliates. That deal is for a reported $266 million and is expected to close in Q3 or Q4. Another transaction to monitor is the potential divestiture of approximately 100,000 acres of Oregon and Washington timberland by SDS lumber. The company is evaluating the possibility of selling the company timberlands, mill, and other operational components.[2] Assuming these listings close and timberland transaction activity holds relatively close to normal to end the year, we are trending towards an average year of completed timberland transaction activity.

So how does our Q1 synopsis hold up given current information? While we may lack the flair worthy of day-time-TV prognosticators, timberland transaction activity does appear to be trending towards a more positive direction compared to 2020. However, this is assuming an ‘average’ second half of the year in terms of transaction activity. We will see what the cards hold for the rest of 2021.

For details on recent timberland transactions and mill investments, subscribe to the Forisk Market Bulletin

[1] https://www.prnewswire.com/news-releases/weyerhaeuser-announces-agreement-to-sell-145-000-acres-of-timberlands-in-washingtons-north-cascades-completes-acquisition-of-southwest-alabama-timberlands-301280989.html

[2] https://www.goldendalesentinel.com/news/new-directions-for-sds-lumber/article_6d01b808-adb8-11eb-90b5-df52f5eb6724.html

Leave a Reply