This blog represents our fourth and final update on timberland sales year-to-date. Earlier this year, we peered into our magic eight-ball for a sense of what the marketplace may hold for 2021. The prediction was murky and frustratingly kept settling on “Ask again later”. Based on the pace of sales at the end of 2020 and in the beginning of 2021, we believed 2021 had the potential to be a bounce back year for transactions. How has that prediction fared?

Timberland transactions totaled approximately 2.1 million acres year-to-date. Before we storm the field and topple the goalposts, let’s take a moment to examine how we arrived here. Most deals this year (54%) took place in the West, accounting for just over 1.1 million acres. Large transactions from this region include Green Diamond’s purchase of 291,000 acres from Southern Pine Plantations and Sierra Pacific’s acquisition of Seneca Jones’ 175,000 acres in Western Oregon. The Southern U.S. accounted for 37% of sales year-to-date. Prominent deals included the Triple T sale of 300,000 acres to Hancock client AP3 and German investment group MEAG’s acquisition of 148,000 acres of the former CalPERS portfolio from Campbell. The Northern U.S comprised the balance of transactions (9%). The Hancock purchase of 90,000 acres in Maine from Wagner and the recent acquisition by the Conservation Fund of 70,000 acres of Wisconsin timberland from the Forestland Group represent the lion’s share of this volume.

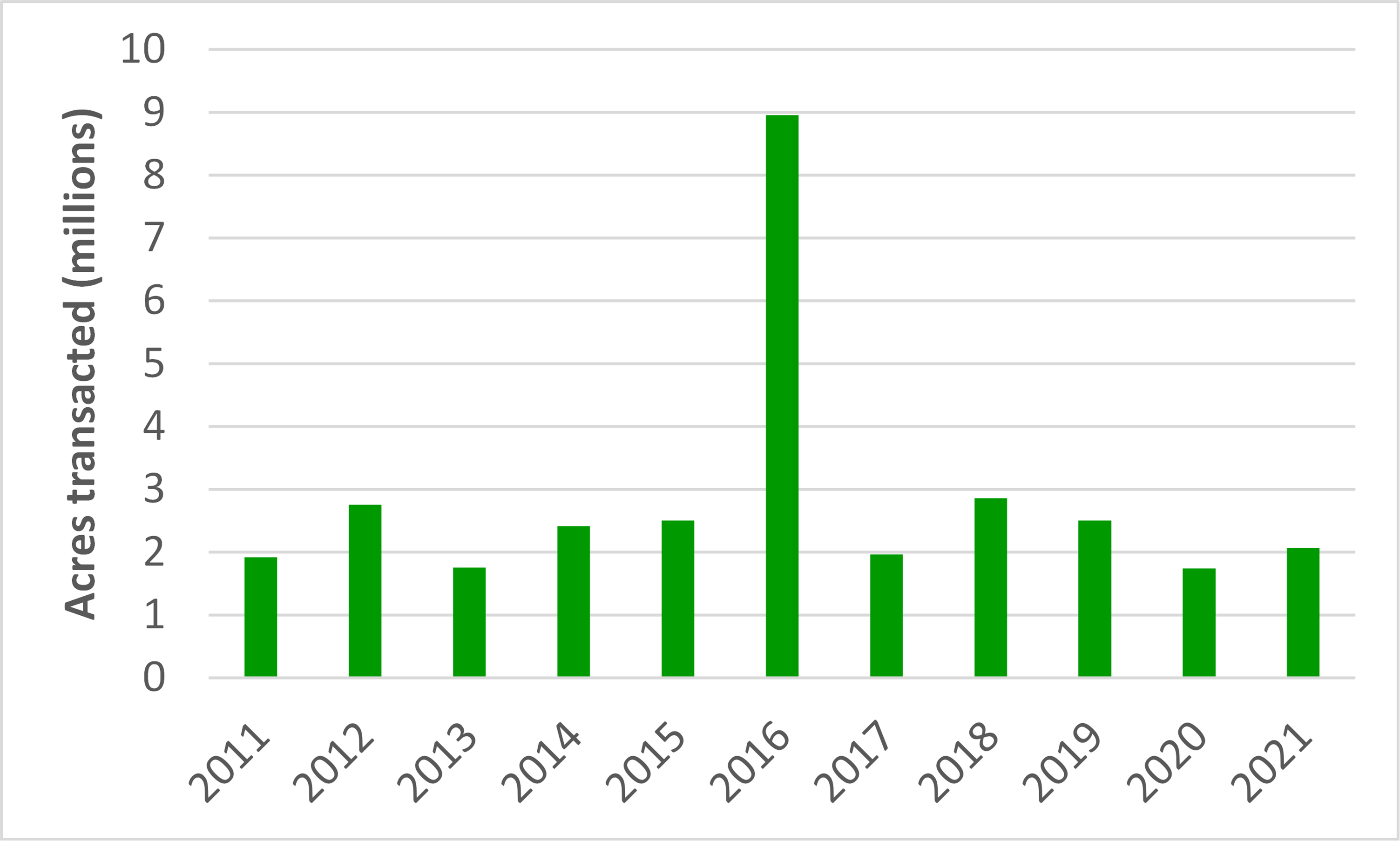

As we noted in Q1, the median level of transaction activity is typically around 2.5 million acres per year (see Figure). While still below this level, sales activity is already up about 19% compared to year-end 2020. Further, there are several large listings with the potential to close by year’s end. These include the Flambeau River timberlands tract (75,600 acres in Wisconsin), the Castle Timberlands tract (60,500 acres in Arkansas and Louisiana), and the Six-West timberlands tract (57,000 acres in Oregon and Washington). The largest listing currently on the market is the Ceres Timberland package being offered by Hancock. This package represents over 238,000 acres in Texas and Louisiana. However, this package will likely not close until Q1 2022 at the earliest. As the end of the year approaches, 2021 does appear to be a return to normalcy for timberland transactions (if little else).

For details on recent timberland transactions and mill investments, consider subscribing to the Forisk Market Bulletin

Leave a Reply