This post includes topics addressed in the (virtual) Applied Forest Finance course on May 19th, 2022.

Answer

Net present value (NPV) and internal rate of return (IRR) can provide conflicting guidance when comparing investments or capital projects with different risk profiles and cash flow timelines. When this occurs, NPV provides the proper signal in all situations where maximizing value (wealth) is the goal. Regardless, both NPV and IRR provide insight and should be estimated when evaluating potential investments, whether in timberlands, sawmills, distilleries, or biotechnology.

Discussion and Example

When considering potential investments, IRR and NPV typically provide consistent guidance, especially when evaluating individual projects with similar risk and timing of cash flows against a common discount rate. However, IRR can prove problematic in certain situations.

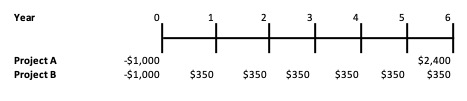

At times, IRR and NPV give conflicting guidance. Consider the following example from Forest Finance Simplified of two mutually exclusive projects with cash flows that differ in timing:

Both projects require $1,000 initial investments. Project A generates $2,400 in cash six years later. Project B generates $350 per year for six years, for a total cash inflow of $2,100. Project A generates more incoming cash, while Project B generates cash sooner.

Let’s apply our standard investment criterion. We find IRRs of 15.7% for Project A and 26.4% for Project B. IRR indicates that Project B is preferable. For NPV (table below), we find that Project A exceeds Project B for low discount rates (at 3% in our example) and Project B exceeds Project A for higher discount rates. When comparing the two, NPV prefers Project A for low hurdle rates and Project B for higher discount rates.

Higher rates severely “discount” the larger, delayed cash flow from Project A, while lower discount rates let the value of the Project A cash flow “stay ahead” of the Project B cash flows as they accumulate over time. This is the “time value of money” in action. Using NPV, our decision to accept or reject the project depends on our discount rate (cost of capital).

The key point is that NPV applies the “actual” or “correct” cost of capital for the firm (the chosen hurdle rate to discount cash flows). This rate is usually “risk-adjusted” to account for the relative riskiness of projects. IRR arbitrarily solves for the discount rate to make NPV equal to zero. NPV also lets us apply a range of discount rates to assess different levels of risk.

NPV and IRR criteria use discounted cash flows to provide proper accept/reject signals for potential investments. In forestry, for example, these criteria can (infrequently) conflict when comparing investment opportunities with differences in timing, duration and risk related to silvicultural treatments, harvest decisions and rotation lengths. Generally, both NPV and IRR provide insight and should be estimated when evaluating potential capital investments.

Leave a Reply