OVERVIEW

With the annual onset of the NCAA tournament, attention shifts towards the nation’s hardwood arenas. As much of the country organizes their brackets, it is helpful to look back at the “rebound” we experienced in an entirely different hardwood (and softwood) arena, timberland transactions. While perhaps falling short of Chamberlain levels, the rebound in 2021 timberland transactions was impressive. Total sales volume increased 60% from 2020 levels to just under 2.8 million acres. This represents the largest single year percentage increase since 2016. Geographically, most transactions occurred in the West (45%), followed by the South (38%) and North (17%). Forest industry firms accounted for 29% of acres sold while TIMOs comprised 32% of acres bought.

HISTORICAL

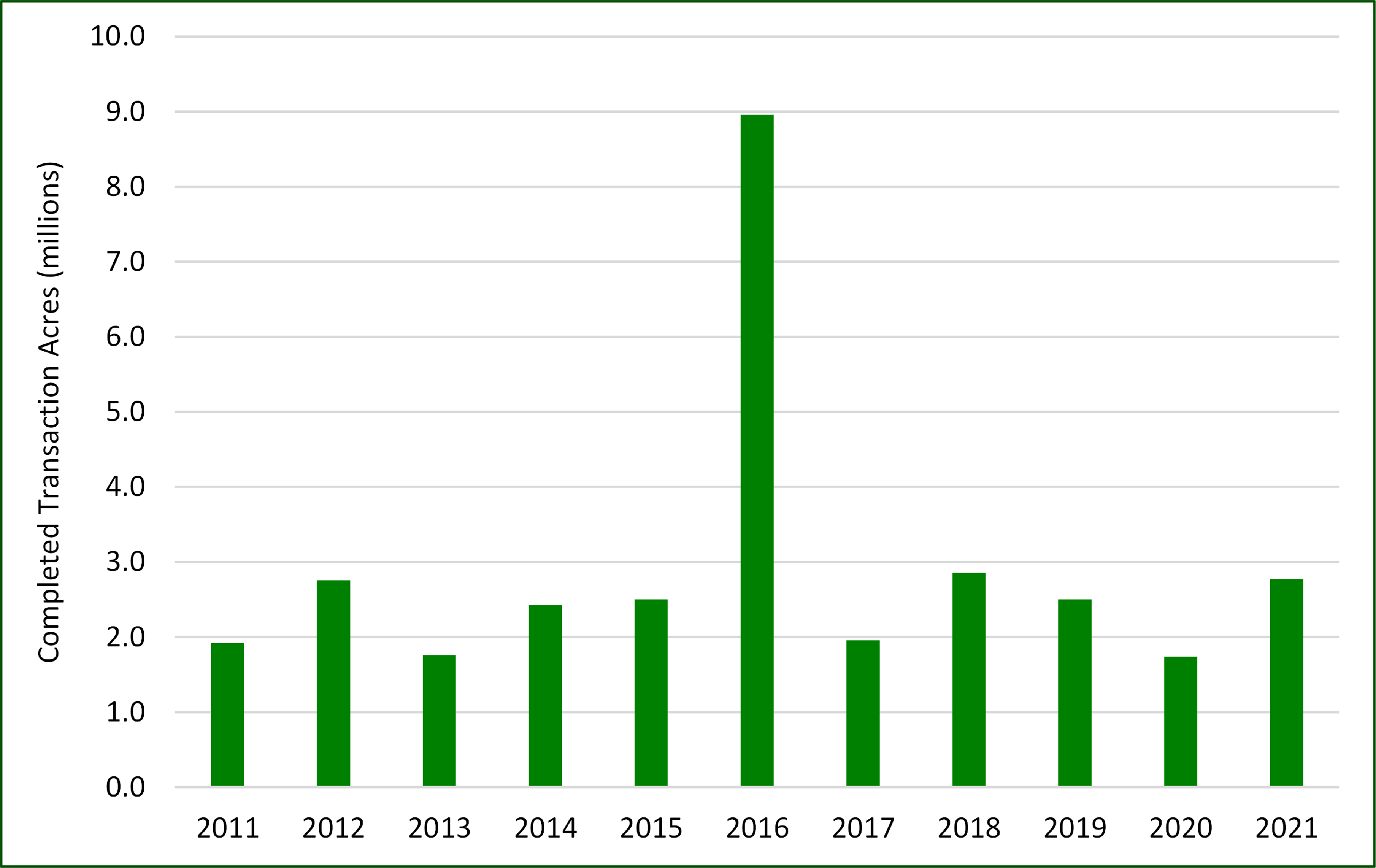

Given the magnitude of the increase, how does 2021 compare to the last decade of timberland transactions? From 2011 to 2021, roughly 2.9 million acres sold per year, on average. The Weyerhaeuser-Plum Creek merger in 2016 inflates this value, though. A more representative estimate for a typical year of transaction activity is the median, roughly 2.5 million acres per year (see figure). From a historical perspective, 2021 sales were around 11% higher than a typical year, and the highest annual total since 2018. This is encouraging given 2020 totals represented the lowest amount in a decade.

LOOKING-FORWARD

What might the future hold for 2022? While predictions are always difficult, we can form some initial impressions from the relatively auspicious Q1 start. In January, the Ontario Teachers’ Pension Plan Board (OTPPB) completed a timberland redemption transaction, acquiring roughly 870,000 acres across the South. Previously, OTPPB invested indirectly in these assets since 2006. However, with this transaction they now control direct ownership of the timberland assets. Resource Management Services will continue to act as the timberland manager. Additionally, the Lyme Timber Company recently sold their California redwood holdings, 112,000 acres in Coastal California, to Redwood Empire. Accounting for these and other completed sales, total transactions already exceed 1 million acres year-to-date. Further, several large listings currently on the market could push this value higher still. Consequently, while 2021 got us back off the sidelines, promising Q1 activity has us on a fast break.

For details on recent timberland transactions and mill investments, consider subscribing to the Forisk Market Bulletin

Leave a Reply