2021 Totals

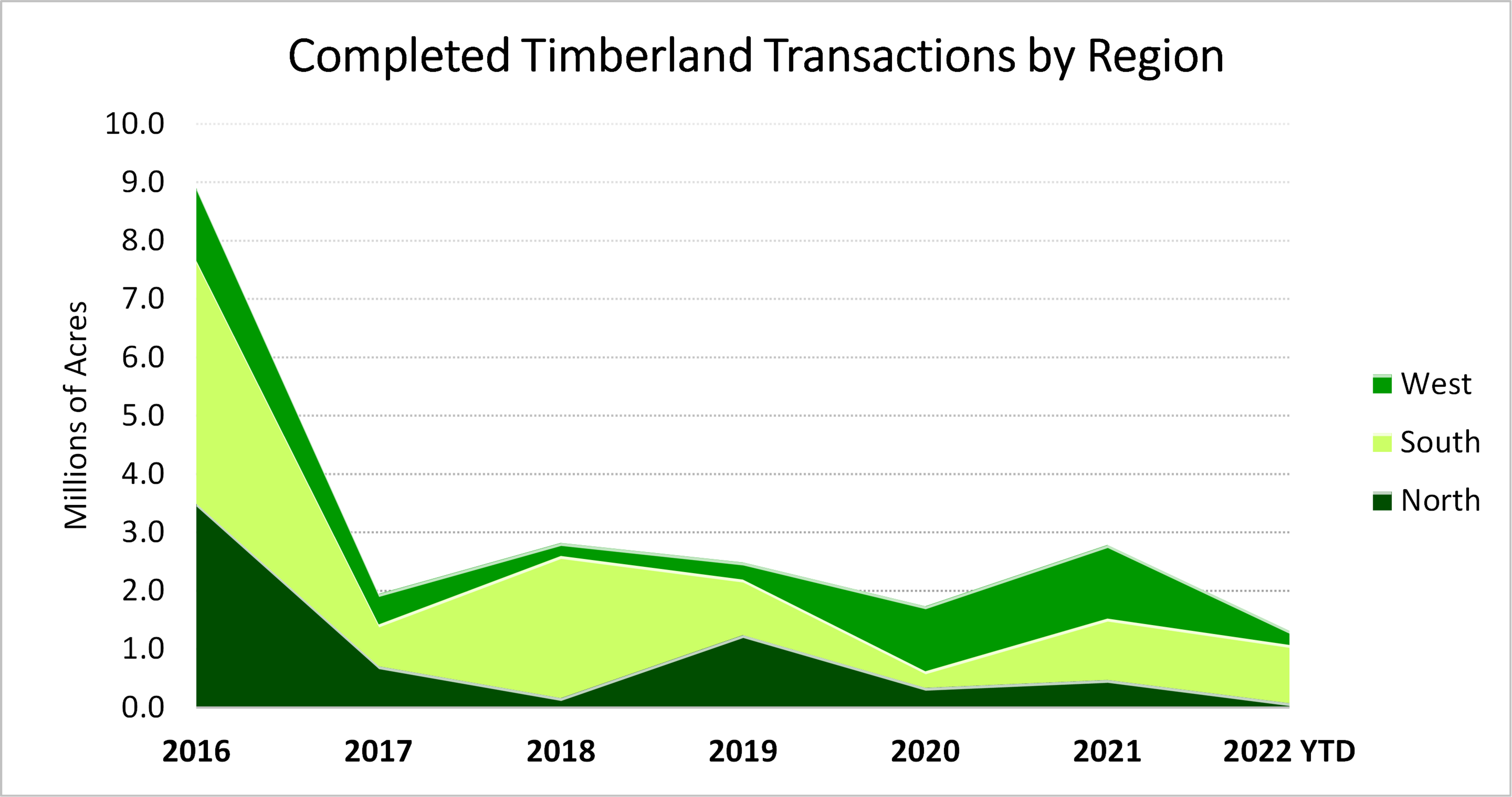

Nearly 2.8 million acres of US timberland changed hands in 2021. This represents a 60% increase from 2020 totals. Regionally, most transaction volume was concentrated in the West (45%) and South (38%). The North accounted for the balance at roughly 17% of 2021 transaction volume. This mirrors the trend of the past several years, which saw most sales occur in the South and West. This pattern appears poised to continue in 2022.

2022 YTD

Year-to-date, approximately 1.3 million acres of timberland deals have closed. Much of this is concentrated in the South, with further deals likely to bolster YTD totals (see ‘Looking Forward’ below). Ontario Teachers’ Pension Plan Board (OTPPB) completed the largest deal year-to-date. The sale, 870,000 acres across the Southeast, was a redemption transaction that saw OTPPB assume direct ownership of the former RMS Tamarack holdings. RMS will continue to act as the investment manager for the asset.[1] Additionally, Weyerhaeuser recently closed on its acquisition of 80,800 acres of former Campbell Global timberland in the Carolinas.[2] Out West, Lyme timber sold 112,000 acres in California to the Redwood Empire company.[3] Also, New Forests purchased 108,000 acres from Michigan-California Timber Company’s Northern California holdings earlier this month.[4]

Looking Forward

Several large holdings currently listed or announced should boost transaction volumes in H2 2022. One prominent deal is the recent announcement where PotlatchDeltic and Catchmark are combining to form an integrated timber REIT. The deal includes Catchmark’s 350,000 acres of timberlands in Alabama, South Carolina, and Georgia, set to close in H2 2022. Under the terms of the agreement, Catchmark shareholders will receive 0.23 common shares of PotlatchDeltic stock for each share they hold. Upon closing, the newly formed company will hold approximately 2.2 million acres across the Southeast and Western U.S.[5] Other notable listings include Manulife’s Ceres and Triptych offerings. Ceres consists of 238,000 acres in Texas and Western Louisiana; Triptych timberlands comprises 86,000 acres in Oklahoma, Texas, and Mississippi. Cumulatively, this would potentially add roughly 675,000 acres of timberland transactions, all in the South.

For details on recent timberland transactions and mill investments, subscribe to the Forisk Market Bulletin

[1] https://www.agriinvestor.com/otpp-assumes-control-of-870000-acres-of-timberland-assets-from-rms/

[2] https://investor.weyerhaeuser.com/2022-04-14-Weyerhaeuser-to-Acquire-Timberlands-in-North-and-South-Carolina

[3] https://www.lymetimber.com/2022/01/31/affiliates-of-the-lyme-timber-company-sell-interests-in-coastal-california-timberlands/

[4] https://newforests.com.au/new-forests-completes-acquisition-of-over-100000-acres-of-northern-california-forests/

[5] https://www.businesswire.com/news/home/20220531005306/en/PotlatchDeltic-and-CatchMark-to-Combine-to-Create-a-Leading-Integrated-Timber-REIT

Leave a Reply