According to The Economist[1], “Private equity benefits from a fig leaf of illiquidity,” which covers up for delays when valuing investment assets and obfuscates their true volatility. The inability to confirm value in real-time or robustly quantify risk sounds, to me, like walking a tightrope in the dark[2], where we don’t know how far we are above the ground at any given moment.

As a forest industry analyst, I follow private equity markets because they have and do play a role in the buying and selling of manufacturing facilities, and they also describe fundamental financing mechanisms for institutional timberlands. Each year at our annual conference, when we share research on forest industry investments, we address the relevance and irrelevance of new information to timber markets and wood-dependent businesses. That means, when considering broader issues in, for example, private equity, I test their relevance to timberland and forest industry clients.

Hunting for Potential Disruptions

This exercise made me revisit an August 2018 blog and related research on potential forest industry disruptions and the relative importance of interest rates to timberland values and discount rates:

“Investors have opportunity costs. If long-term U.S. Treasuries offered a 7% yield, net returns from alternate investments should exceed this… increasing interest rates absent changes to cash flow generation increase pressure on valuations…”

Today, interest rates are rising, which affect borrowing costs and home values. Yet, many macro and industry-specific fundamentals continue to favor the forest industry: demographic trends, an aging and underbuilt housing stock (new homes needed!), and strong employment (people have jobs and savings). The overbuilding of homes and multi-layered mortgaging that fronted the 2007-2009 Great Recession differ materially from the situation today in the U.S., where:

“…corporate debt as a share of GDP, at around 80%, has been at or near record highs over the past two years…”[3]

U.S. corporate debt levels and the growth of private equity, which tripled its capital over the past 15 years, comprise a round mound of obligations. When firms borrow to finance capital investments, any growth in cash flow and earnings should meet or outpace the interest expense required to service that debt. When interest rates rise, this becomes harder, especially for the syndicated loans and private-debt markets favored by private equity that often use floating (variable) rate debt.

Relevance to Timberlands

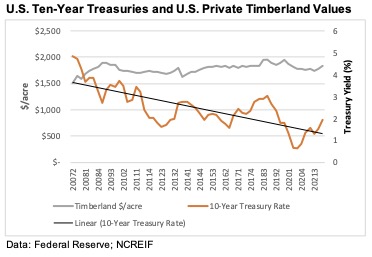

Timberland investments require a useful view of value and risk. Interest rates, through discount rates and the “market for money,” affect timberland valuations and expectations. However, the relationship over the past fifteen years between interest rates and average timberland values raises questions (figure). While, on average, 10-year U.S. Treasuries yields fell more than 50%, average private institutional timberland values in the U.S. increased more than 20% (with most of that increase occurring in 2007 and 2008, and values remaining plus/minus flat the past 12-13 years).

Buying or rehabilitating riskier assets (the private equity specialty) or paying higher prices for reliable ones (observed with timber), ultimately pushes returns lower. While reaching for assets may provide good value relative to bonds when interest rates are low, they can also grow risk within a portfolio, especially as interest rates rise. If and when investors flee financial assets for non-monetary alternatives such as gold and land to preserve wealth, timberlands may continue to profile quite well. However, this depends on a continued source of aggregate demand (a healthy economy).

There is a pecking order for investment opportunities, where public and private equity returns should outperform bonds which, in turn, should outperform cash by suitable margins to account for the relative risk. Without appropriate inter-asset “risk premiums”, the capital markets, as we want them to function, will fail and collapse. Risk-adjusted discount rates and transparent valuations can help us avoid that.

The “illiquidity” pinned to private equity actually serves as a protective moat in the world of timberland investing. Still, we need clear asset and firm values to understand true default risk. Loan-to-value means you know the loan amount and the asset value. When folks load up on debt, they create a situation that must, ultimately, be unwound, so we want to be sensitive to this as the exposure extends beyond the individual firm.

Please join us for our one-day, virtual “Wood Flows & Cash Flows” conference on August 25th, 2022. For information on sponsorship opportunities, please contact Heather Clark (hsclark@forisk.com).

*My submission for the most riveting blog post title of 2022.

[1] “Private equity may be heading for a fall,” The Economist, July 7th, 2022.

[2] Don’t try this at home.

[3] “As interest rates climb and the economy cools, can companies pay their debts?” The Economist, July 3rd, 2022.

2022 seems like a great time to be invested in hardwood forestland. Despite the illiquid/long term nature of forestry investments, natural resources are in short supply and timber prices are staying ahead of inflation. After 2 decades of apathy, American manufacturers have a renewed interest in keeping a local supply chain.