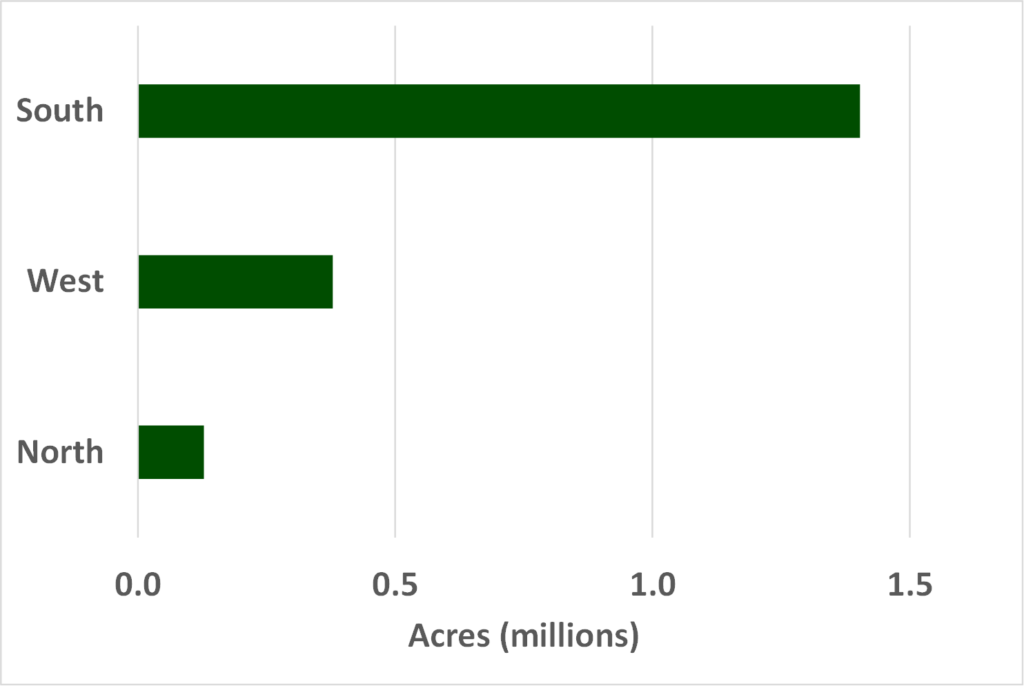

After a bounce back year in 2021, 2022 is shaping up as another strong year for timberland transactions. Year-to-date, over 1.9 million acres of timberland deals have closed (see figure below). The ten year median value of timberland deal flow is approximately two and a half million acres per year. However, for a normal year of activity we might expect a range of anywhere from about two to two and a half million acres. This would put us just below the lower end of the range with another four months to go in 2022.

While year-to-date totals are encouraging, 2022 demonstrates a different geographic profile than the previous two years. In 2020-2021, 53% of deals occurred in the West, compared to 29% in the South and 18% in the North. Contrast this to 2022 where 73% of completed deals have been in the South. The West and North comprise the balance with 20% and 7%, respectively. While movement across regions is not uncommon (we see a shifting profile in the last few years), the concentration of deals in the South is noteworthy. What is driving these southern volumes?

Much of it can be attributed to the Ontario Teachers’ Pension Plan Board’s (OTPPB) redemption transaction in Q1. This transaction saw OTPPB assume direct ownership of 870,000 acres across the southern U.S. Notwithstanding this deal, the South is still the dominant region year-to-date. The Gulf South in particular has seen a large amount of activity. Manulife completed its sale of the Ceres timberland tracts, accounting for over 238,000 acres in Texas and Louisiana. Manulife’s sale of the Triptych timberland package accounted for another 86,000 acres in Mississippi, Oklahoma, and Texas. Lastly, Molpus’ sale sale of the Castle package contributed another 58,000 acres in Arkansas and Louisiana.

In addition to deals already completed, several large holdings currently listed or announced should boost transaction volumes in the South. PotlatchDeltic and Catchmark are combining to form an integrated timber REIT. The deal includes Catchmark’s 350,000 acres of timberlands in Alabama, South Carolina, and Georgia. Also, Manulife is offering their Project Dionysus timberlands, a collection of over 163,000 acres across Texas, Alabama, and Georgia. These two deals would add another half million acres to the South, potentially raising 2022 volumes to more than 2.4 million acres.

For details on recent timberland transactions and mill investments, consider subscribing to the Forisk Market Bulletin

Leave a Reply