Housings starts jumped more than 12% in August to a seasonally adjusted annual rate (SAAR) of 1.58 million units. Most of the gain was in multifamily construction, rising 29% to a SAAR of 621 thousand units. Single family starts were relatively stable, increasing 3.4% in August to a 935-thousand-unit pace. Despite some recent signs of softening, the number of housing units currently under construction rose considerably over the past two years, reaching a 1.7-million-unit SAAR in August. This represents a record level of construction activity, the highest in more than fifty years. Given that the U.S. experienced decades of underbuilding of entry level homes, contributing to a housing shortage of 3.8 million units in 2020, this is certainly an encouraging trend.[1] However, what is driving this ramp up in homes under construction?

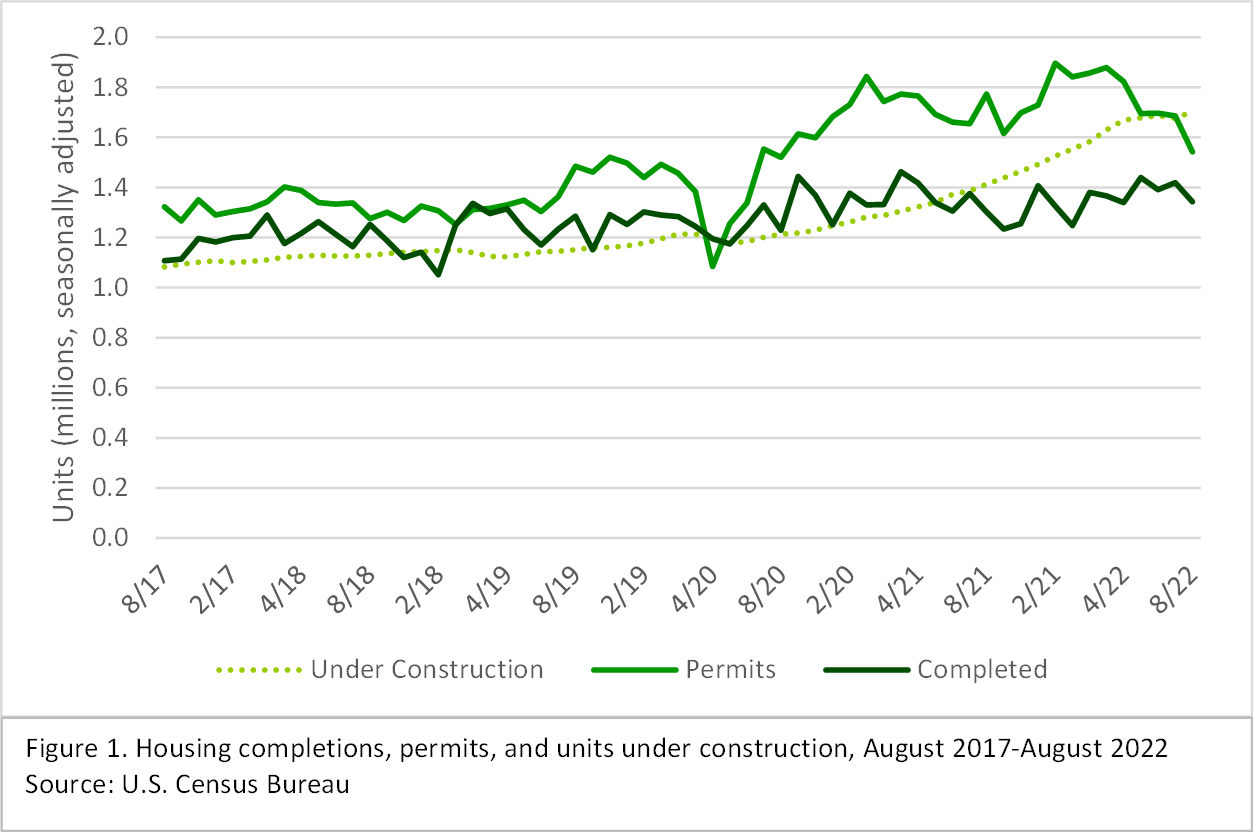

Since the advent of the pandemic, the spread between housing permits and completions widened considerably (see Figure 1). Permits rose sharply, increasing 18.1% from 2020 to 2021 before beginning to moderate earlier this year. Completions also rose during this period, albeit at a lower rate, up 4.2% from 2020 to 2021. As mentioned in our Q2 update, supply chain issues have been persistent: a lack of truck drivers, inventory shortages, and congested ports hampered the housing industry’s ability to ramp up construction to meet rising demand. Consequently, the number of houses under construction rose considerably, with current levels 43% higher than January 2020.

Recently, the gap between permits and completions has narrowed. In August, the difference between the two measures was roughly 200 thousand units after having been as high as 600 thousand in January. New permits fell 8.5% in August to a 1.54-million-unit SAAR. Permits have decreased 19% since their December 2021 peak. This decline is also reflected in the NAHB/Wells Fargo Housing Market Index (HMI), a gauge of builder confidence. The HMI continued to fall in August, the 9th consecutive monthly decline. Current builder confidence levels are the lowest since the advent of the pandemic.[2] As supply chain issues continue to work their way through the system and permits decline, we might expect to begin cutting into the historically high levels of homes under construction.

Interested in learning a process for tracking and analyzing the price, demand, supply and competitive dynamics of local timber markets and wood baskets? Register here for Forisk’s 2022 “Timber Market Analysis” class, offered virtually via Live Zoom on November 16th and 17th. Early registration ends November 2nd!

[1] https://www.freddiemac.com/research/insight/20210507-housing-supply

[2] https://www.nahb.org/news-and-economics/press-releases/2022/09/builder-confidence-falls-for-ninth-straight-month-as-housing-slowdown-continues

Leave a Reply