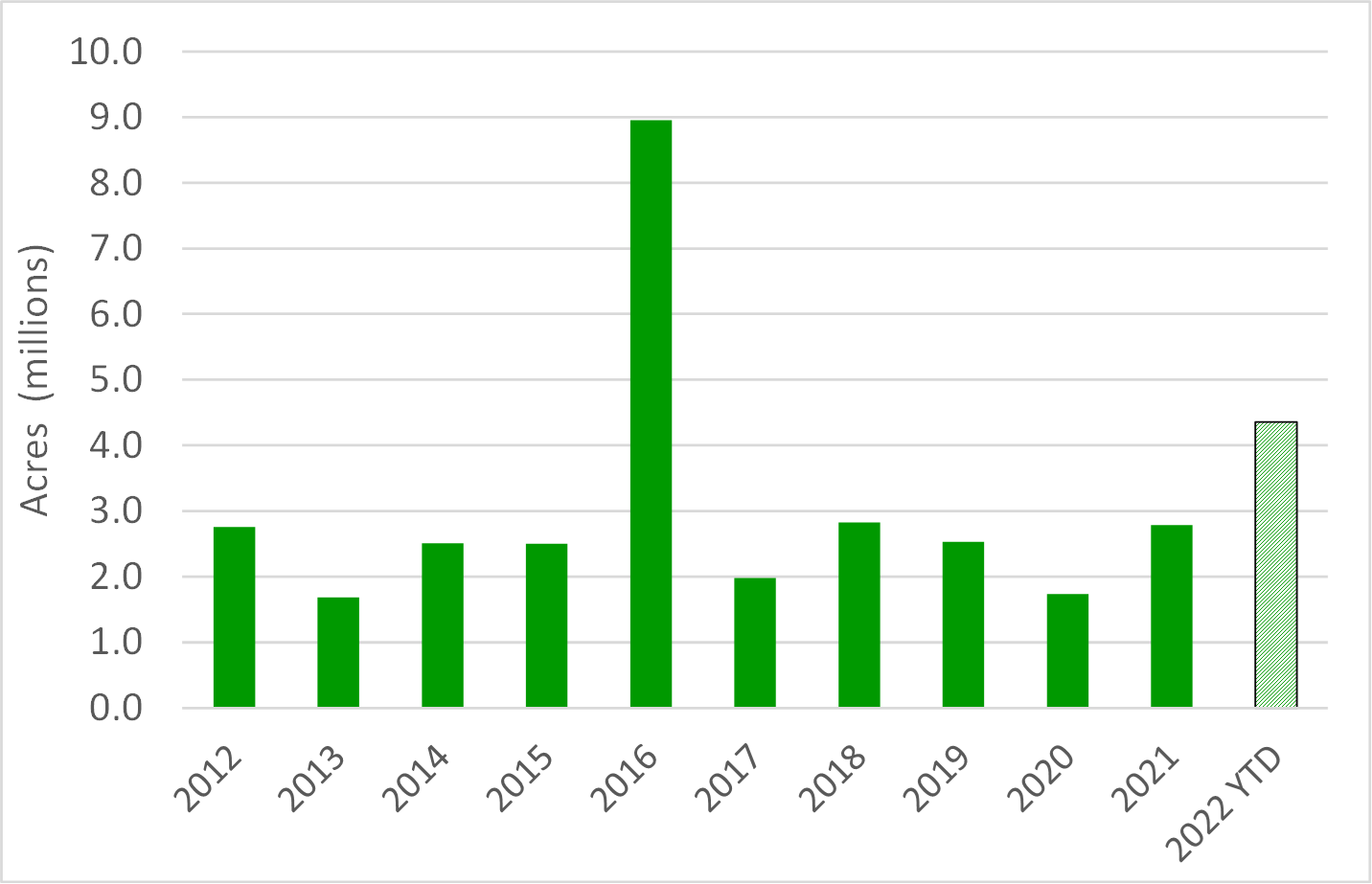

This represents our final update on timberland in 2022. After an action packed twelve months, where do we stand as we close out the year? Before we dive into 2022’s performance, let’s review some recent history. We bounced back in a major way in 2021. Total acres sold reached just under 2.8 million, a 60% year-over-year increase from 2020. Given that timberland sales generally range from about 2.0 – 2.5 million acres per year over the past decade, 2021 was an above average year for transaction activity (see figure). How does 2022 compare? Are we above or below average for the year?

Year-to-date, nearly 4.4 million acres of U.S. timberland changed hands. This represents the largest single year of transaction activity in more than five years. Additionally, this total represents a 56% year-over-year increase from 2021. As such, 2022 was well over the range of a typical year of transactions. That said, where did these transactions take place?

Regionally, much of the volume occurred in the U.S. South. The largest deal in this region was the redemption transaction between Ontario Teachers’ Pension Plan (OTPP) and RMS[1]. This saw OTPP assume direct ownership of more than 870,000 acres across the U.S Southeast. Other notable transactions include two large Manulife sales along with the merger between PotlatchDeltic and Catchmark. The PotlatchDeltic-Catchmark merger accounted for 350,000 acres across Georgia, Alabama, and South Carolina. Meanwhile, Manulife’s sale of the Ceres package, 238,000 acres in Texas and Louisiana, as well as the Dionysus package, 163,000 acres across Texas, Alabama, and Georgia, accounted for a significant portion of the Southern volume. The Ceres acreage was split relatively evenly between BTG and Molpus, while the Dionysus acreage was acquired by Rayonier.[2]

In November, Bluesource Sustainable Forests Company (BSFC) purchased 1.7 million acres from The Forestland Group for a reported $1.8 billion. The deal included properties spread over 17 states, constituting the largest forest carbon specific market transaction to date.[3] In October of 2021, Oak Hill Advisors (OHA) collaborated with BSFC, creating a $500 million joint-venture for acquiring forest lands for carbon projects.[4] In December of 2021, OHA was acquired by T. Rowe Price; BSFC and Element Markets then merged, recently changing their new brand name to Anew.[5]

Looking forward, several large listings remain on the market. This includes Molpus’ Tristar package, approximately 47,000 acres spread across Idaho, Texas, and Louisiana. Also, Rayonier is offering the Olive Project package, roughly 11,000 acres in Washington state. While 2021 may have seen a return to normalcy for timberland transactions, 2022 went above and beyond. Now we will have to wait and see what 2023 will bring. I’m so excited I can’t put my arms down!

For details on recent timberland transactions and mill investments, consider subscribing to the Forisk Market Bulletin.

[1] https://www.woodworkingnetwork.com/news/canadian-news/ontario-teachers-pension-plan-acquires-870000-acres-us-timberland

[2] https://www.businesswire.com/news/home/20221102006105/en/Rayonier-Announces-Acquisitions-in-U.S.-South

[3] https://www.globenewswire.com/news-release/2022/11/02/2546812/0/en/Anew-and-OHA-Led-Investor-Consortium-Acquire-1-7-Million-Acre-Timberland-Portfolio-to-Expand-Improved-Forestry-Management-for-Climate-Action.html

[4] https://www.bluesource.com/press-releases/sustainable-forest-co/

[5] https://www.globenewswire.com/en/news-release/2022/06/14/2462201/0/en/Element-Markets-and-Bluesource-Formally-Merge-to-Create-Anew.html

Leave a Reply