This post includes topics addressed in the (virtual) Applied Forest Finance course on May 16th, 2023.

What is a timber lease? In the book Forest Finance Simplified, I define timber leases as “contractual agreements that provide the lessors (owners) equal annual payments from the lessees (users) for use of their land to grow and harvest trees.”

A recent phone call with forest owner in Louisiana about a 99-year lease had me revisiting this topic and definition.[1] The nature and structure of timber leases offer a range of basic and important financial questions from which we can learn. For example, in the case of this Louisiana lease, instead of equal annual payments, the original lessor received a single lump-sum payment from the lessees that equated to $25 per acre 75 years ago.

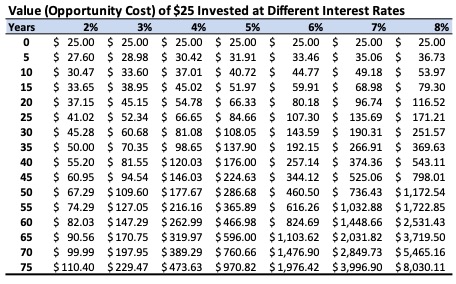

Investments have opportunity costs. Once we allocate capital, it is unavailable for other uses, so we want to have a perspective on how the decision could meet our financial objectives. What would that $25 be worth today if it was put into another, diversifying investment such as stocks or bonds? One approach to assess and communicate the financial implication of this timber lease is to consider how the $25 received 75 years ago must appreciate to cover our opportunity costs.

To do this, we can compare its future value across a range of interest rates over time (see table). These rates can be hypothetical or represent actual alternative investments for our capital. For example, 30-year U.S. Treasury Bonds currently yield 3.92%. The dividend yields of publicly traded timberland-owning REITs range from 2.27% to 3.84% as of March 2023.

The table reinforces the power of compounded interest across rates and over time. At 6%, $25 approaches $2,000 in 75 years.

While I hear three primary reasons for owning or acquiring timberlands – to make money (investment), to manage risk (diversify a portfolio or secure wood supplies), and to recreate (huntin’ and fishin’) – they all benefit from understanding opportunity costs. How else could we use our resources to meet our objectives? What else could we do with our time or money? Which should we choose? Basic financial tools and frameworks help organize our thinking to make optimal decisions given our opportunities and what we know at the time.

#

[1] My thanks to Dr. Glen Melton for sharing this situation with me and allowing me to apply it in class.

The author makes a good point about alternative investments and the power of compounding. However, inflation and taxes are also factors that should also be considered. That $25 in 1948 (75 years ago) would have to be worth $324 in 2023 just to keep up with inflation, which as measured by the CPI-U has been compounding at about 3.5% annually over that timeframe. Of course one can argue about the appropriateness of the CPI-U to look at a timberland investment, but one cannot argue that there’s been inflation to consider since then. Another fact that one cannot argue about is that the IRS is going to want some tax on any increase in value on that $25, even if it is just an inflationary gain. And over a 75-year period, estate considerations may also possibly be a part of the timberland decision process. As the author noted, basic financial tools and frameworks are important to help organize our thinking. I’d add that equally important can be good financial advisors who have a sound understanding of timberland investments.