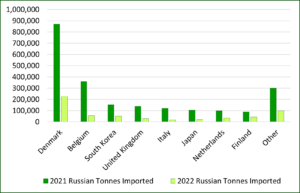

Following the start of the conflict, many western countries and their allies imposed strict economic sanctions on Russia and many major European utilities halted biomass purchases from Russia, as discussed in the Q2 2022 FRQ. According to data from FutureMetrics, Russia exported 578,803 tonnes of pellets in 2022, a 74% decrease compared to 2021. The country also decreased its market share from 10% of total exports to 2%. The top importers of Russian pellets by tonnage in 2021 were Denmark, Belgium, and South Korea. In 2022, exports to those countries fell 74%, 84% and 67%, respectively. The drastic fall in exports from Russia show the impact of the sanctions, mostly (Figure 1).

Figure 1. Russian pellet exports to selected countries in 2021 and 2022, according to FutureMetrics.

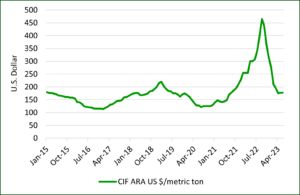

Structurally, the North American pellet supply chain has not changed year-over-year. Much of the capacity remains locked up in take-or-pay contracts. Prior to the conflict, this left European and Asian consumers to call Russia, Vietnam and the Baltics for spot deals. The reduced spot supply caused spot prices of pellets delivered CIF Amsterdam, Rotterdam, Antwerp (ARA) to increase 82% between February 2022 and September 2022 to $438 a tonne delivered, according to Hawkins Wright. Delivered prices have since decreased 62% between the peak in September 2022 to this past June (Figure 2).

Figure 2. Spot CIF Amsterdam, Rotterdam, Antwerp (ARA) pellet prices through June 2023, according to Hawkins Wright.

Leave a Reply