This post includes themes and topics related to timberland investment vehicles that will be addressed in the (virtual) Applied Forest Finance course on March 14th, 2024.

For me and my family, I rely on investing approaches built on classic lessons and finance fundamentals. Start saving and investing early in your career to crank the flywheel of compounding interest. Minimize costs to keep more of what you earn. Diversify to mitigate risk.

Other strategies help, too. For example, a commitment to regular and systematic investing, instead of trying to time the market, reduces emotion and anxiety while supporting a proactive approach to building wealth. My Dad taught me about this when he introduced me, years ago, to the concept of dollar-cost averaging.

With dollar-cost averaging, you regularly and systematically invest a fixed dollar amount, regardless the share or fund price or situation in the overall market. When prices are up, you will buy fewer shares, and when the market is down, your allocation pays for more shares. This strategy tends to result in a lower average cost per share over time when compared to lump-sum purchases.

If you participate in a workplace retirement plan with monthly contributions, such as a 401(k), you effectively employ dollar-cost averaging. This strategy keeps you invested in the market without any need to deliberate over “timing” the market. In addition, users of 401(k) accounts and the like typically trade less frequently in those accounts, further reducing costs and preserving capital.

Dollar-Cost Averaging in Timber

In forestry, the easiest vehicles for applying a dollar-cost averaging strategy are the publicly traded timber REITs (PotlatchDeltic (PCH); Rayonier (RYN); and Weyerhaeuser (WY)). Investing directly in timberland has more complications, requires more time, and burns more “shoe leather” as they say with respect to due diligence. Dollar-cost averaging works best with low transaction cost, liquid investments amenable to regular, systematic investing. Public timber REITs satisfy these criteria.

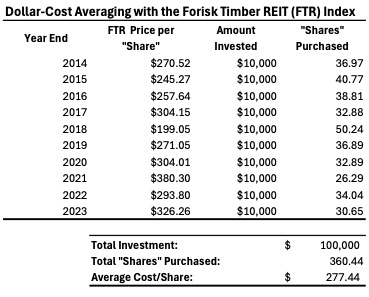

The Forisk Timber REIT (FTR) Index, commonly called the “footer index,” is a market capitalization weighted index of the public timber REITs. Initiated in 2008 along with the FTR Total Return Index, the FTR Index provides a useful benchmark for comparing timber REITs to other timberland investment vehicles and the overall market.[1] As an example, the figure below summarizes a dollar-cost averaging approach to investing in the timber REIT “sector” based on buying $10,000 worth of FTR Index shares at the end of each year for ten years from 2014 through 2023.

With this strategy, the weighted average cost per “share” is $277.44, while the straight average of the ten year-end prices was $285.21. With dollar-cost averaging, your portfolio has more of the lower-priced shares and fewer of the most expensive shares, which brings down the weighted average. The strategy, of course, is not always advantageous. If you had simply purchased $100,000 worth of shares at $270.52 in 2014, you would have been better off. However, this is hard to know in the moment. For that reason it helps to think of dollar-cost averaging as a robust and systematic approach to cost-effectively stay invested over time.

Conclusion

With dollar-cost averaging, you buy shares of a stock or fund regularly over time at the prevailing prices. With this approach, your average cost is neither the highest nor lowest market price. It is a weighted average that systematically acquires more shares when they are cheaper and fewer when they are dear.

[1] To subscribe to the free weekly FTR Index Summary and to obtain historical FTR Index data in an Excel format, please contact Pamela Smith, psmith@forisk.com.

Leave a Reply