This post includes themes and topics that will be addressed in the (virtual) Applied Forest Finance course on March 14th, 2024. Early registration ends February 29th!

The business of forestry does not operate in a vacuum. Investors compare timberlands to alternative finance products, funds, and strategies. Capital flows around the world searching for the best returns relative to the associated risk. For these investors, risk management does not exist for its own benefit, but rather supports their efforts to protect asset values and optimize returns.

When investors acquire timberland assets, they do so with strategies and harvest schedules that seek to maximize the present value and returns of the property. Anything that destroys assets, slows growth, or defers cash flows tends to diminish returns. Anything that increases present value faster than the investor’s opportunity cost, often expressed in the discount rate, enhances value.

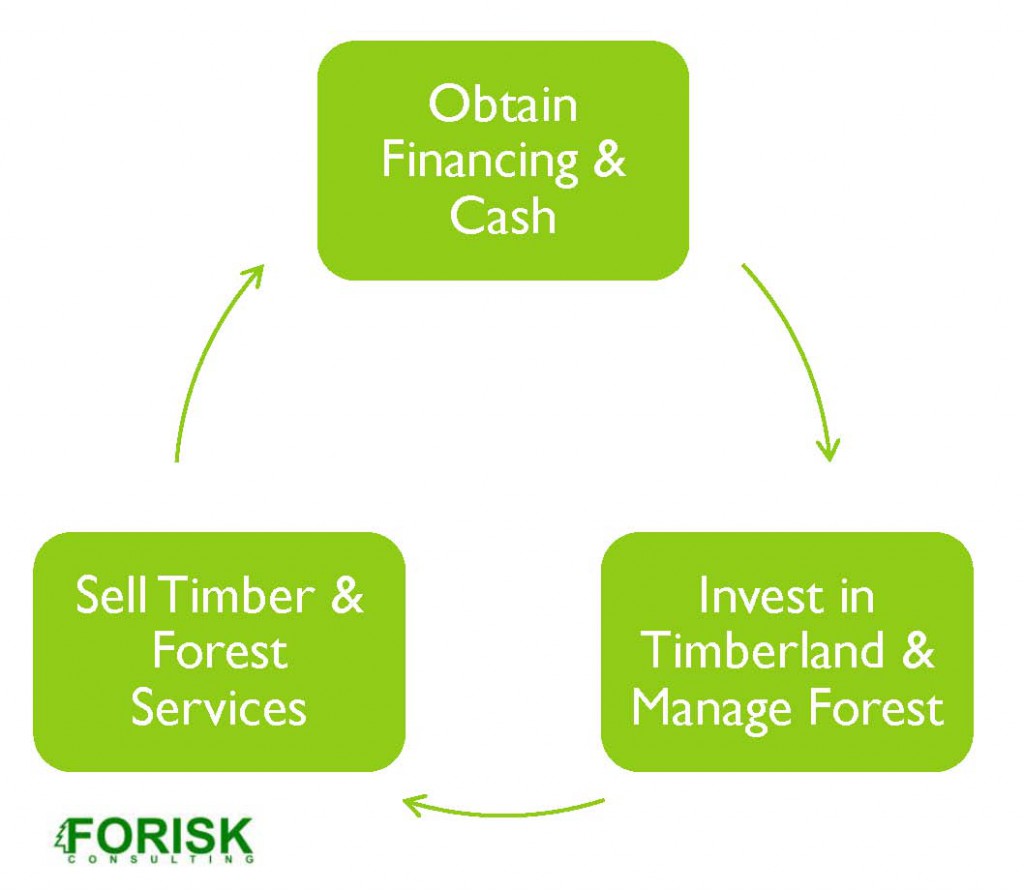

Circular Flow of Funds

Managing the risk of forestry and timberland investments fits with the “circular flow of funds” approach to financial management, which focuses on two fiduciary objectives. One, raising and supplying the funds required for timber-related investments on favorable terms. Two, using these funds effectively and efficiently to maximize returns. In short, raise money at low rates and invest it in trees at higher rates. Simple, right?

In practice, achieving these objectives depends on regular, consistent flows of cash to non-cash assets (forests and wood) back to cash. The cycle continues, assuming no disruptions in forest operations, local timber markets, acquisitions and divestitures, or administrative activities.

How do we measure timber investment success from this perspective?

- Cash flow circulates uninterrupted.

- Circle of cash grows and increases in value.

- Speed of cash flow accelerates.

- Circle continually spins off cash for other investments.

Thus, a critical benefit of the “circular flow of funds” approach is that it facilitates quantitative measurement of investment performance against specific, prioritized timberland investment objectives. In short, it provides an effective way to keep score.

Pricing to Perfection

When acquiring and benchmarking timberland, a key risk is overpaying, and this manifests in different forms. One is paying a premium price for an average asset or for an asset in a below average wood basket. Another way to overpay is to apply a valuation assuming perfectly optimal operational and biological performance of the forest and supply chain. How often do forest growth, harvesting activities, weather patterns, price forecasts, personnel decisions, and the state of the economy mirror our expectations from a decade ago, much less last year?

When timberlands are “priced to perfection”, the circle is bigger and harder to grow, harder to accelerate, and harder to de-risk. Inertia and exposure increase, and we worry about, on the margin, liabilities that could erode the size of the circle or slow it down.

Conclusion

The price of an asset can vary from its fundamental value over time because of uncertainty associated with future cash flows. As asset prices rise, the cash yield – whether bond coupons, stock dividends, real estate rent, or timber harvests – falls as a percentage of net asset value. Uncertainty increases interest in hard assets such as gold, land, and timber. And with land and timber, the localized nature of the asset provides distinct investment opportunities. However, over subscription to the asset class can lead to the evaporation of localized differences, as hungry investors ‘overpay’, providing opportunities to knowledgeable sellers. And then the reverse opportunity exists when markets correct.

Nicely stated. A pet peeve of mine is when people calculate their return based on their cost, as opposed to the present value. (I have heard this on prominent investment podcasts.) Buying at $50 and getting a $5 dividend is not a 10% yield if the current value is $100.

to the current owner of the property, “yield” actually IS based on one’s cost and the “total return” is a combination of yield plus the increase in market value (in your example above from $50 to $100). a potential buyer (assuming they are “knowledgeable”) being concerned with “value” would calculate a range of present values that would represent an acceptable bid. the calculation of a discount rate is probably the most challenging part of this exercise. the market that i live and “operate” in could not be more disconnected from the economics of the “timber” business. land (and timber prices) trade at prices that are driven more by “recreation” value than anything else – try figuring a discount rate to reflect that risk level.

Thank you, Mike! Good points.