On the evening of August 4th, 2010, Neena Mishra, our Director of Equity Research, and I will teach a Master Class on “Valuing Timber REITs.” This follows our day-long course on “Applied Forest Finance”, which is co-taught by our Forest Economist, Dr. Tim Sydor. Why teach these classes? Demand for and interest in timber-related investment vehicles: timberlands, timber REITs and forest industry ETFs.

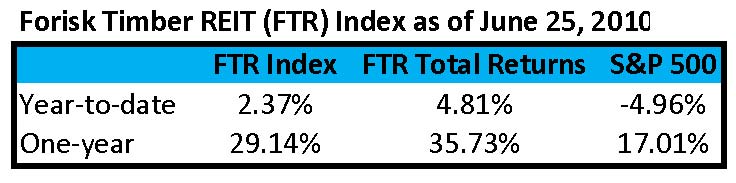

Publicly-traded timberland-owning real estate investment trusts, as measured by the Forisk Timber REIT (FTR, “footer”) Index, continue to outperform the S&P 500 (see table below). The FTR Index includes Plum Creek (PCL), Rayonier (RYN) and Potlatch (PCH). Weyerhaeuser (WY) will join the Index once, if expected, it completes its REIT conversion later this calendar year.

Why the strong interest? Once we cut through the traditional arguments for timberlands – strong long-term risk-adjusted returns, effective portfolio diversification, potential/possible inflation hedge – timber-related investments provide simple, stable business models. Timberlands and timber REITs generate cash and appreciation through maximizing the value of hard assets through the business cycle.

Why the strong interest? Once we cut through the traditional arguments for timberlands – strong long-term risk-adjusted returns, effective portfolio diversification, potential/possible inflation hedge – timber-related investments provide simple, stable business models. Timberlands and timber REITs generate cash and appreciation through maximizing the value of hard assets through the business cycle.

The biggest risk for a potential investor is paying too much to get in. The biggest risk for a current investor is sub-optimizing the assets under management. As such, key metrics for evaluating timber REITs include net asset value (NAV), relative performance against private timberland investments and cash flows, both current and expected.

Please join us August 4th to learn more and participate in a hands-on session.

Leave a Reply