Publicly-traded timber REITs – Plum Creek (PCL), Potlatch (PCH), and Rayonier (RYN) – continue to outperform the S&P 500, as measured by the Forisk Timber REIT (FTR, “footer”) Index. Key results as of September 20, 2010 include:

- FTR Index up 5.47% (annualized) year-to-date compared with 1.32% (annualized) for the S&P 500.

- FTR Index currently comprises 3.72% of the market cap of all publicly-traded real estate investment trusts (REITs).

- Assuming Weyerhaeuser (WY) completes its REIT conversion this year, timber REITs will exceed 7% of total public REIT capitalization.

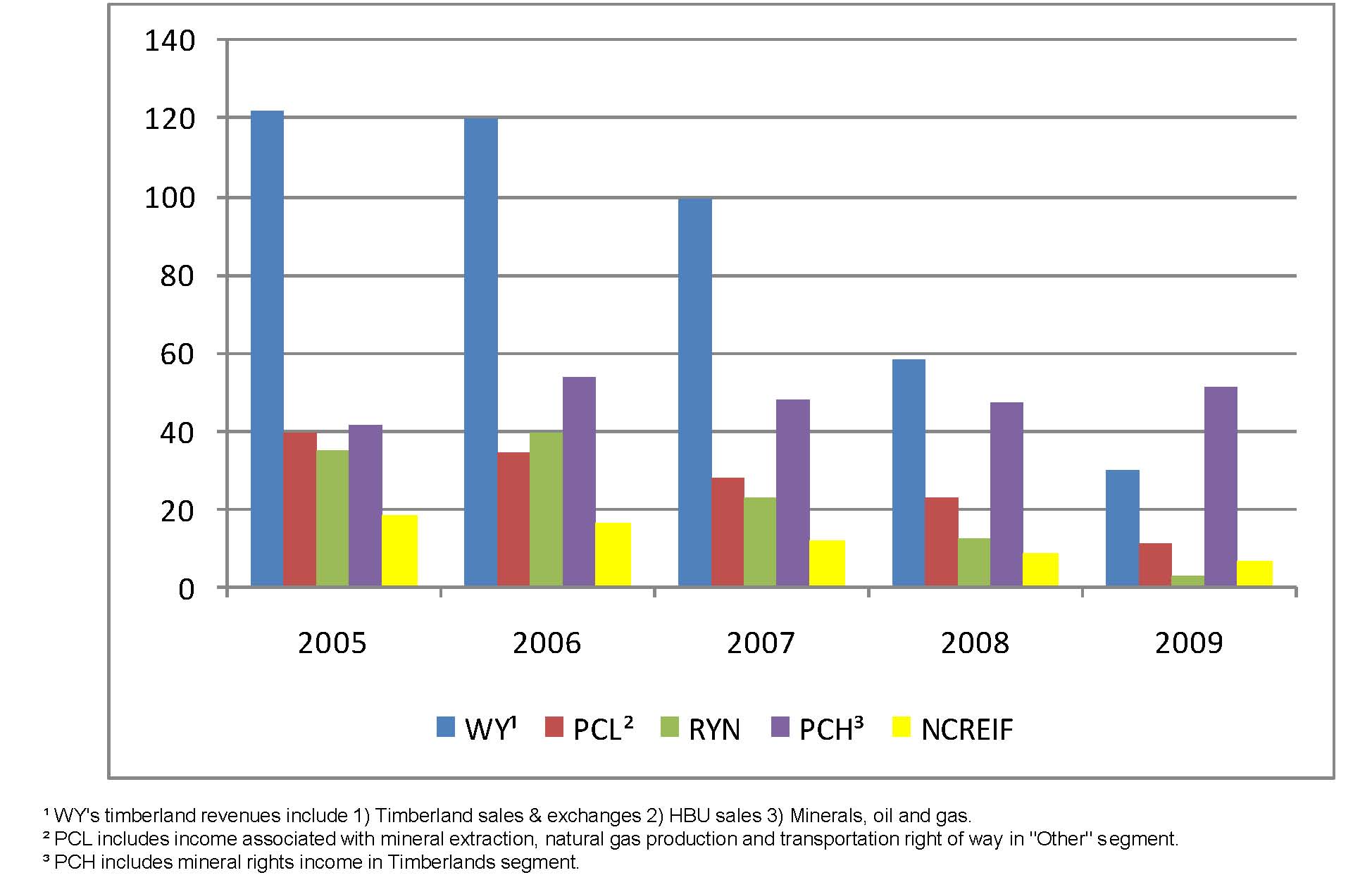

Looking back, the per-acre operating income generated from the timber REITs, WY (still a C-corporation) and private timberlands (as reported by NCREIF) varied based on tax structure, financial reporting differences, geographic locations of the timberlands, alternate access to end markets, and forest types (see figure below).

Looking forward, good timber REIT income generated from increasing demand and prices for wood raw materials depends on the revival of the housing markets and resulting increased demand for lumber. Recent reports provided a spot of positive news. Housing starts rose 10.5% in August, to a seasonally adjusted annual rate of 598,000, compared to the consensus expectation of a 0.2% decline to 545,000. A 32.2% jump in multifamily starts, which represent a small and volatile portion of the housing market, drove the increase. Building permits also rose 1.8% for the month, though year-over-year, total permits were down 6.7%. In response to the better-than-expected data, the lumber futures contract on the CME rose $10, the daily limit, to $232 per MBF.

For FTR Index calculation methodology and to subscribe to the free FTR Weekly summary, click here.

For information regarding Forisk Equity Research and quarterly coverage, please contact Brooks Mendell, bmendell@forisk.com.

Leave a Reply