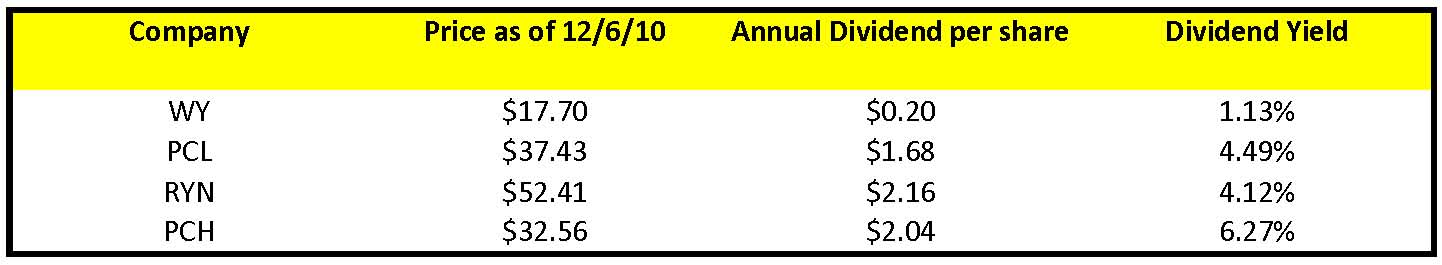

On December 3, 2010, Potlatch (PCH) announced its quarterly dividend of $0.51 per share, to be paid on December 27, 2010 to shareholders of record on December 13, 2010. At current prices, Potlatch’s dividend yield is 6.27%, substantially above the yields of its timber REIT peers, Plum Creek (PCL) and Rayonier (RYN). Weyerhaeuser (WY), which is expected to elect REIT status effective January 1, 2010, when it files tax returns in early 2011, will provide guidance to its dividend policy as a REIT this month. We expect WY’s dividend to be below the average for the group. [Please see our earlier blog on the topic.]

Timber REITs primarily fund their distributions using cash flows from their REIT-qualifying timberland operations. However, significant declines in timber prices and reduced harvest levels impacted cash flows from timberland operations. The shortfall between the cash available for distribution from operations and the dividend distributions are funded through revenues from sales of timberlands and cash flows from the taxable REIT subsidiaries (TRSs).

During the 12 months ending September 30, 2010, Funds Available for Distribution (FAD) also called Cash available for Distribution (CAD) for PCH was $77.7 million, whereas the dividend payout during this period was $81.5 million. During 2009 and 2010, PCH cash flows have been supported by major asset sales, such as: 24,800 acres in Arkansas to RMK Timberland group for $43.3 million (2009); a timber deed transaction with FIA for 49,536 acres of pre-merchantable timber for $49 million (2009); and 41,700 acres (August 2010) and 46,400 acres (October 2010) of timberlands in Wisconsin and Arkansas, for $28.7 million and $36.0 million respectively to RMK Timberland Group. After closing the final phase of its land sale to RMK, Potlatch had a cash balance of ~$105 million and should be able to fund dividends at the current level through 2011. Management stated that it will continue to defer harvest but hold the dividend at the current level, and then restore harvest levels as housing recovers to support the dividend. However, as dividend payments are not supported by FAD, there remains a risk for the reduction of dividends by PCH if housing markets lag longer than expected by Management.

Leave a Reply