Our previous post on Weyerhaeuser’s (WY) dividend guidance noted that Standard & Poor’s (S&P) Rating Services raised its outlook on WY from “negative” to “stable.” How does S&P rate the three publicly-traded timber REITs? How are rating agencies intended to protect the interests of investors?

While US financial markets source debt capital, rating agencies play a role in informing investors about the credit risk of debt securities and their issuers. The rating agencies do not make recommendations about buying or selling securities; rather they release independent ratings and opinions about the credit worthiness of a company or a financial product. Over the past two years, the three major credit rating agencies – Standard & Poor’s (S&P), Moody’s and Fitch – have been severely criticized for failing to flag the risks built up in financial institutions ahead of the credit crisis . As a result, late last year, the Securities and Exchange Commission (SEC) tightened regulations on the credit-rating agencies and in turn, the agencies strengthened the performance criteria applied to the firms they rate. Currently only four nonfinancial firms – Johnson & Johnson, Microsoft, Exxon Mobil and ADP – earned S&P’s highest rating (AAA).

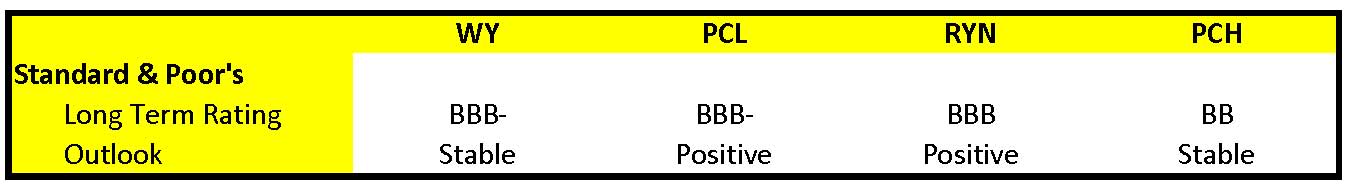

The following table summarizes S&P’s ratings and outlook on the four companies that we follow:

What should investors keep in mind regarding the credit ratings scale?

- In rating long-term debt, agencies use alphanumeric letter grades to locate user/issue on the credit quality spectrum, starting from “AAA” (extreme strong capacity to meet financial commitments) and ending at “D” (has been a payment default).

- Each latter grade has three notches and S&P uses + and – as modifiers. “BBB” and above are considered “Investment” grades and “BB” and below are considered “Speculative” grades.

- Ratings are subject to revision and the agencies update their Outlook on a continuing basis.

- A “Positive” outlook indicates that the rating may be raised and a “Negative” outlook indicates that the rating may be lowered, while “Stable” indicates a neutral outlook.

Leave a Reply