Two-thirds of the nearly 6.2 million acres that Weyerhaeuser (WY) owns and leases in the United States are located in the South. Our Equity Research team matched WY’s timberland acres to Forisk’s state-by-state forecast of stumpage prices and wood demand to assess the revenue growth potential for the next five years from WY’s timber operations in the US South.

Forisk forecasts state-specific pine sawtimber and pulpwood prices in the South for eleven states. These forecasts use statistical models that establish relationships between stumpage prices and the state-specific demand for timber relative to other states. These relationships allow each state to individually “express” its price relationship to changes in, for example, sawtimber demand (driven primarily by the housing markets) over time.

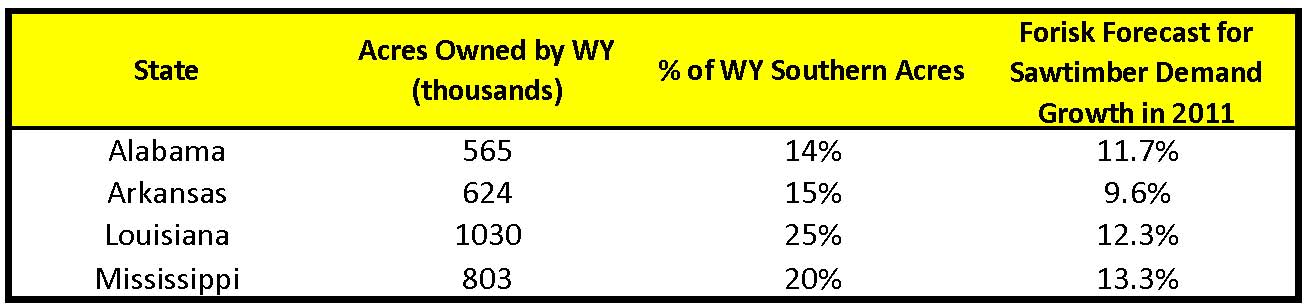

According to our models, the top five states in the US South in terms of demand growth for 2011 are Mississippi, Louisiana, Alabama, Tennessee and Arkansas. Approximately three million acres, or 74% of WY’s southern timberlands, are located in four out of five of these high growth markets. Since these markets are expected to outperform the other Southern states with respect to demand growth, this positions WY’s timber business to outperform the South-wide average assuming any strengthening in housing and lumber markets.

During the housing downturn, WY deferred its harvest substantially and plans to increase harvest by approximately 10% this year and 70% from the current levels over the next 10 years.

Leave a Reply