A duck walked into the doctor’s office and asked, “Doc, how do you treat timber REIT dividends?”….

Distributions from real estate investment trusts (REITs) have three elements:

- Distributions representing firm Operating Income are taxed at investors’ ordinary (marginal) tax rates.

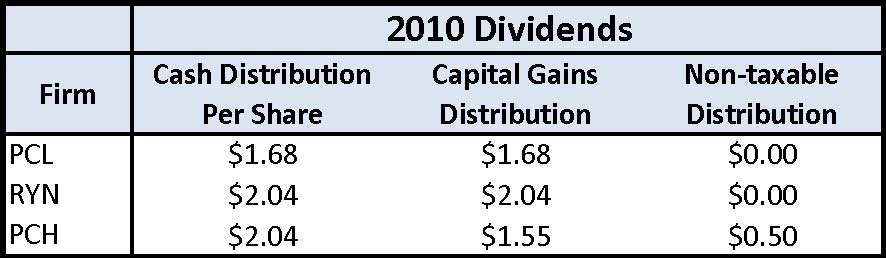

- Capital Gains distributions – from the sale of income-producing properties – are taxed as…capital gains (15% for most investors).

- Return of Capital Distributions, which essentially represent the original cost of sold properties, are not taxed.

Relative to other REITs, timberland-owning REITs benefit from an attractive tax profile at the investor level. Timber REITs derive substantially all of their income from selling standing timber (pay-as-cut) contracts and income from these contracts is treated as long-term capital gains. (see Table for 2010 results for three timber REITs)

To learn more about timber REIT assets, strategies and valuations, participate in the “Investing in Timber REITs” workshop on August 23rd in Atlanta.

Leave a Reply