Last week, Fitch Ratings raised its outlook on Weyerhaeuser (WY) from “negative” to “stable” and affirmed its rating at “BB+”. Fitch justified the action primarily on WY’s Pulp business and core Timberland operations, though the rating agency recognized that the company’s financial performance continues to suffer from depressed housing markets via its Wood Products and Real Estate businesses. Given the Fitch action, we take this as an opportunity to revisit the current ratings across the firms we track in the timber REIT space.

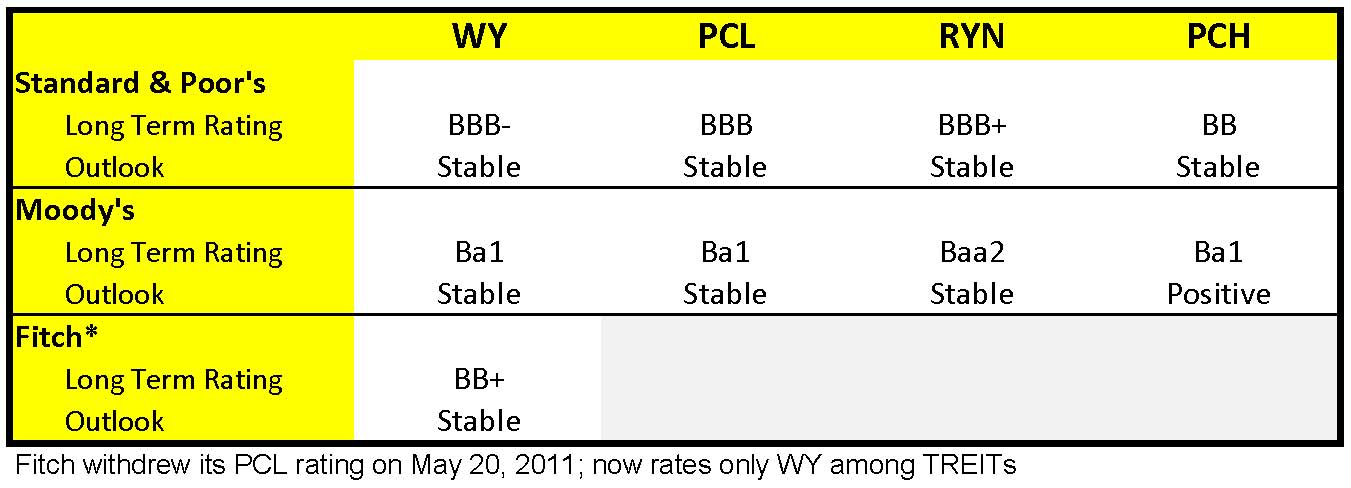

The table summarizes current ratings for the publicly-traded timberland-owning REITs by the three major credit rating agencies: Standard & Poor’s (S&P), Moody’s and Fitch. The rating agencies do not make recommendations about buying or selling securities; rather their ratings are intended to provide independent, objective and informed opinions about the credit worthiness of each company.

In rating long-term debt, the agencies use alphanumeric letter grades, starting from “AAA” (extreme strong capacity to meet financial commitments) and ending at “D” (has been a payment default). Each letter grade has three notches and S&P uses + and – as modifiers. “BBB” and above are considered “Investment” grades and “BB” and below are considered “Speculative” grades. Ratings are subject to revision and the agencies update their outlook on a continuing basis. A “Positive” outlook indicates that the rating may be raised and a “Negative” outlook indicates that the rating may be lowered, while “Stable” indicates a neutral outlook.

Leave a Reply