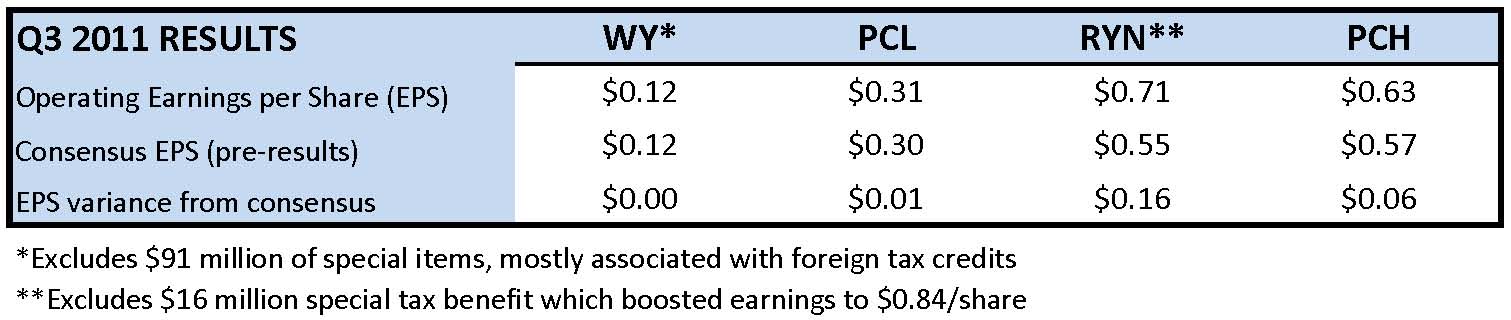

Last week, all four publicly-traded, timberland-owning REITs announced and reviewed their third quarter 2011 results (just in time to catch Game 7 of a heart-thumping World Series between the St. Louis Cardinals and Texas Rangers). All firms met or exceeded consensus expectations, even accounting for special items (see table). During their Earnings Calls, two timber REITs referenced, but did not name, the closure of Georgia-Pacific’s Crossett, Arkansas lumber and plywood facility, which had the capacity to consume close to 1 million tons of pine sawtimber annually. This represents a material loss of demand in a key Southern market, and will influence timber REIT valuation models sensitive to state-level stumpage pricing and wood demand. Alternately, all firms cited demand from China as a driver of strong log pricing and demand in their Western markets, though Weyerhaeuser noted this demand had softened since the second quarter.

Firm-by-firm highlights include:

- Weyerhaeuser (WY) reported net earnings of $157 million for the quarter ($0.29 cents per share). Excluding after-tax gains of $91 million from special items, including an $83 million benefit related to foreign tax credits, WY earned $0.12 per share. Timberland earnings declined $50 million in the third quarter compared with the second due to: (1) earnings from dispositions of non-strategic timberlands declined $28 million to $4 million; (2) average prices for Western logs fell from weaker Chinese and domestic markets; (3) prices for Southern logs declined; and (4) silviculture and road costs increased (seasonal). In addition, CEO Dan Fulton echoed two themes we’ve been sharing with clients from our research. First, WY has outsized exposure to housing across business segments relative to other timber REITs. Two, current housing forecasts often understate the impact of multi-unit homes, which can use 50%+ less wood per housing unit relative to single family dwellings.

- Plum Creek (PCL) reported Q3 2011 earnings of $50 million ($0.31 per share) versus $32 million, or $0.20 per share in Q3 2010. Northern Resources reported a $7 million operating profit for the quarter, up $2 million for the same period in 2010. Sawlog and pulpwood prices were, respectively, 7% and 8% higher than in Q3 2010. Southern Resources earned $21 million for the quarter, down $4 million for the same period of 2010. While prices remained stable and slightly up since last quarter, sawlog prices were 15% lower and pulpwood prices were 17% lower than average prices for Q3 2010. PCL sold ~36,000 acres of lands during the quarter and completed the acquisition of 50,000 acres of timberlands in Georgia and Alabama. Finally, PCL repurchased ~670,000 shares of common stock at an average price of $34.87 per share (closing price as of 10/28/11: $38.47).

- Rayonier (RYN) reported Q3 net income of $105 million ($0.84 per share). Excluding a $16 million tax benefit related to the 2009 alternative fuel mixture credit (“AFMC”), net income was $0.71 per share. Forest Resources reported Q3 2011 operating income of $11 million, up $2 million, which offset higher logging costs in the Northern region and lower results in the Atlantic and Gulf regions primarily due to forest fire impact and soft grade markets. Performance Fibers reported operating income of $75 million, up $13 million. CEO Lee Thomas noted that RYN increased its 2011 guidance, and that RYN’s 190,000 ton expansion of high purity cellulose specialties capacity at its Jesup mill is “on track” with “approximately 70% of this new volume…already committed.”

- Potlatch (PCH) posted stronger earnings across business segments this quarter relative to the same period in 2010. Net earnings for Q3 2011 were $25.6 million ($0.63 per share) compared to $18.1 million ($0.45 per share) for Q3 2010. The Resource segment benefitted from the Northern region’s seasonally strongest quarter. Fee harvest volume for the Northern region tripled since last quarter. Also, Southern fee harvest volume increased 33% in Q3 2011 over Q2 2011 from increased pine plantation thinnings. Real Estate revenues totaled $14.8 million in Q3 2011 compared to $19.0 million in Q2 2011. Wood Products earning $2.9 million in Q3 2011 versus $2.8 million in Q2 2011.

For those of you not keeping score at home, the Cardinals won….

Leave a Reply