Executive Summary: all timberland investment vehicles exceed US Treasury benchmarks over long time frames; timber REIT dividend distributions enhance yields to help offset short term share price volatility.

U.S. Treasuries remain a common benchmark for private timberland investments. Why? Relative safety and low risk over long time frames. However, U.S. Treasuries, thanks to a robust secondary market, are more liquid than private timberlands, making them convenient benchmarks for publicly-traded timber REITs. Over time, how have timberland investment vehicles performed against U.S. Treasury 10-year notes? First, let’s take a (BRIEF) moment to revisit the world of bonds and government debt.

US Treasury Refresher

Treasury yields refer to the total amount of money you earn on U.S. Treasury bills (less than 1 year terms), notes (2 to 10 year terms) or bonds (longer than 10 year terms) sold by the U.S. Treasury Department to pay for the U.S. debt. Remember: Treasury yields fall when demand increases for Treasuries, which investors view as safe investments. As with timberlands, when prices go up, expected returns on capital invested go down. Treasury yields change daily because few investors hold them to term. Rather, investors resell them on the open market.

One reason we care about Treasury yields is because when they increase, so do interest rates on fixed-rate mortgages. This increases the cost of buying homes and decreases the demand, and prices, of those homes, which can slow the economy. This coincides with a second reason why timberland investors take such a strong interest in Treasuries: they affect the costs of building and buying homes, which influence the supply and demand of forest products such as lumber, OSB and plywood.

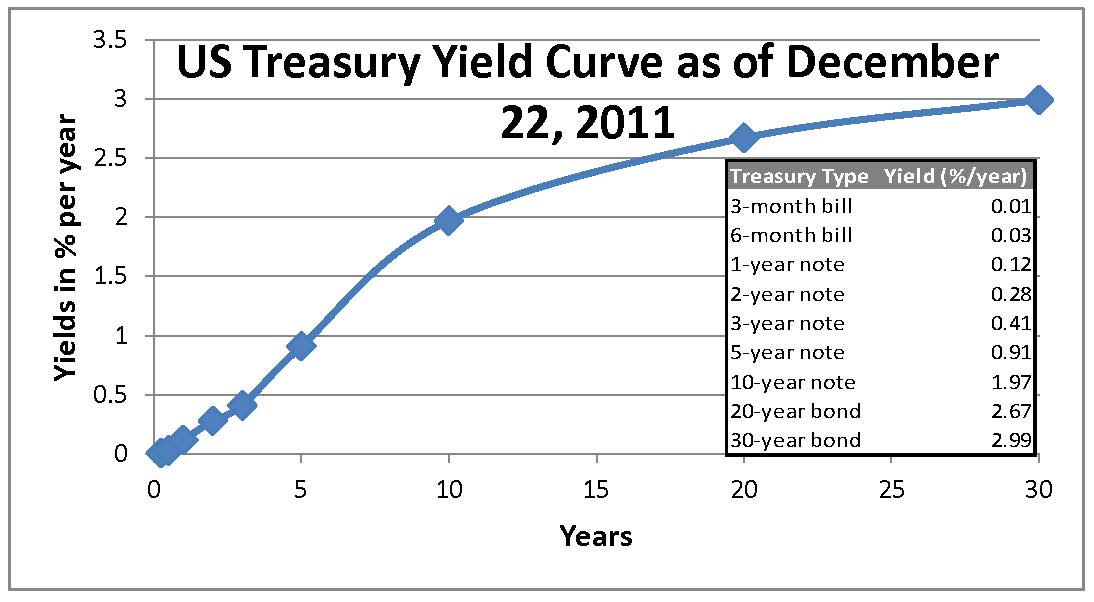

Usually, Treasuries with longer time frames have higher yields. Why? Because investors require higher rates of return for locking up their capital for longer periods. The figure shows the “yield curve” as of December 22, 2011.

Yields remain abnormally low due to economic uncertainty. Investors accept these low returns in exchange for safety. When shorter-term yields exceed longer-term yields to produce an “inverted yield curve,” it reflects near-term concerns of potential recessions. Inverted Treasury yields occurred in April 2000, prior to the 2001 recession, and in January 2006, prior to the most recent recession.

US Treasuries versus Timberlands and Timber REITs

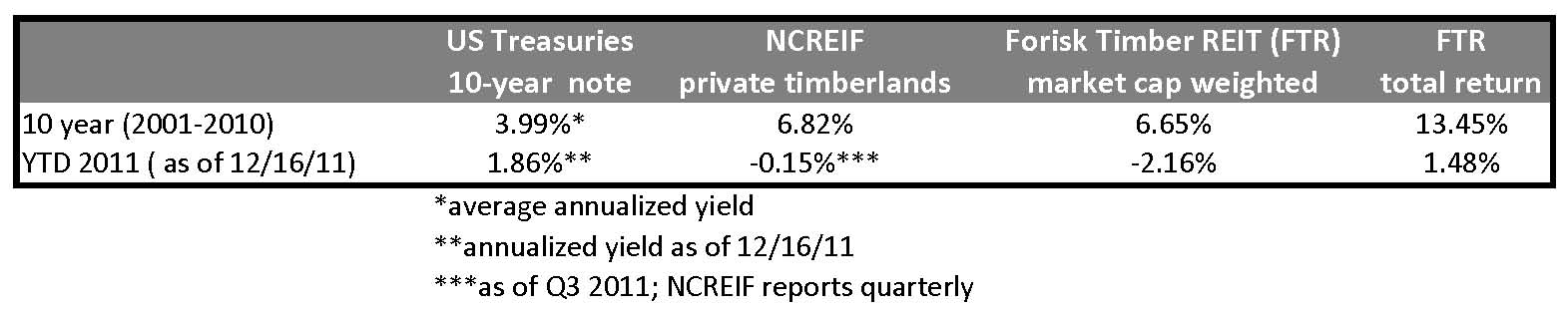

On an annualized basis and year-to-date, how have timberland investment yields benchmarked to 10-year US Treasuries? For the ten year period from 2001 through 2010, both private (less liquid timberlands) and public (more volatile timber REIT stocks) investment vehicles outperformed US Treasuries (see table).

Year-to-date, shorter term market volatility has punished equities and private timberland markets reflect the cresting of timberland prices over the past three years. Still, for those holding public timber REITs, the positive cash flow associated with quarterly dividend distributions offset share price declines, as reflected in the FTR Total Returns Index.

Leave a Reply