This is the second in a three-part series related to the financial performance, current trends and changing structure of the timberland investment sector.

Part I of Timber in Turmoil (Private Timberland Purgatory) focused on the history versus current reality of US timberland returns. The “purgatory” reflects the sluggish willingness of investors to resolve disparate timberland return expectations even though buyers and sellers have clear, unadulterated understandings of the return potential of forestry assets. To paraphrase a quote attributed to a salty Winston Churchill story, we have established what you are, we’re simply haggling over price.

This purgatory highlights a paradox: even with increased transparency into the viable financial performance of timberland, we observe few transactions during a period of high demand. Hmmm. Perhaps it’s too simplistic to ask “why do buyers and sellers ignore forestry fundamentals and cling to unrealistic return expectations?” In fact, if we autopsy the market, we see active restructuring as timberland investment professionals grapple with the limited availability of investment-grade timberland properties in the US.

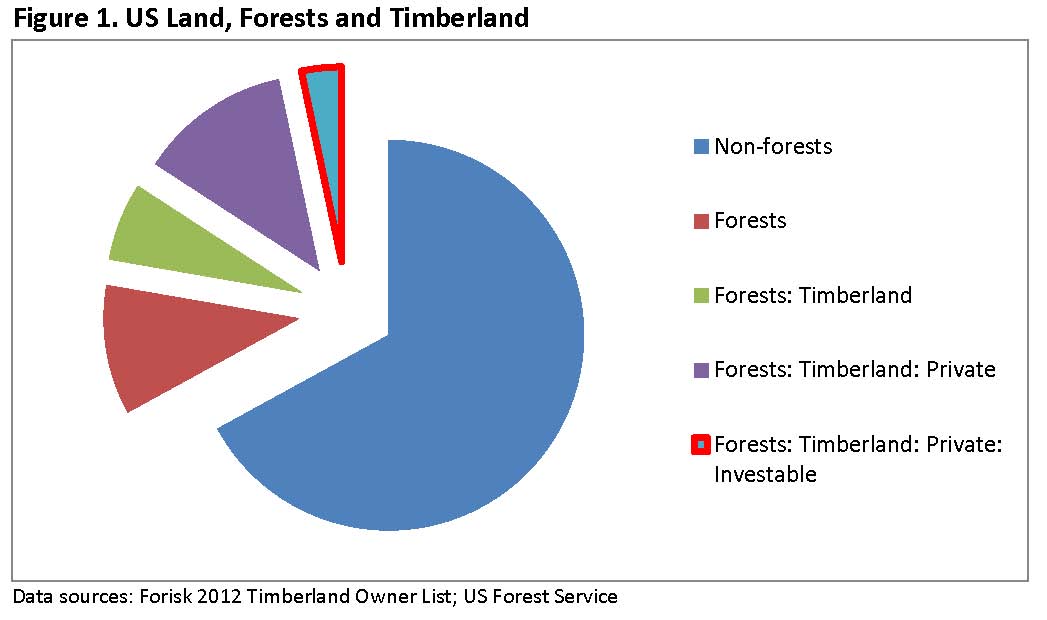

How can timberland be in short supply for investors? In a country of 2.2 billion acres, the US boasts over 745 million acres of forests. This includes 504 million timberland acres, of which 48% is privately owned. However, the reality remains that industrial forest production and institutional investment occurs on a small slice of real estate, accounting for about 75 million acres, or 3.3% of the US land base (Figure 1). Most of these acres are owned and managed by a few dozen entities. In short, the US timberland market comprises (relatively) constrained acreages and (relatively) few scalable participants.

Insistent timberland investors have four primary strategies in the US.

- Pay more today (in exchange for lower returns tomorrow).

- Wait for markets to firm (and spend time filling the queue with candidate properties and timber markets of interest).

- Reallocate capital away from timberland assets.

- Consider alternate timberland investment strategies, including timber leases, multi-asset packages (that include mills), and traditional M&A (mergers and acquisitions) driven consolidation among TIMOs and REITs.

In practice, we see investors employing all of the above.

Consolidation deserves special note because it represents a bellwether. Consolidation reflects the arrival of mature markets; we’re past adolescence. The boys are back from the war. And as Lt. Frank Drebin said in The Naked Gun 2 ½, “the cows have come home to roost.” While traditional timberland investment strategies mirror a game of musical chairs, investors have reopened the playbook. They now willingly consider a broader set of timberland investment approaches that leverage opportunities afforded by time, localized expertise and complexity.

Part III addresses the role of publicly-traded timberland-owner REITs in the timberland investment sector. For detailed data on US timberland ownership and more information on Forisk’s 2012 US Timberland Owner List, click here.

Leave a Reply