This is the first in a two-part series related to the analysis of wood baskets and timber markets for investments in forest industry mills, wood-using bioenergy projects and timberland.

When analyzing timber markets or wood baskets, paranoia regarding stumpage price data may serve you well. Why? Two reasons. One, each stumpage price data set – no matter its source, perceived quality, consistency, depth and structure – reflects a (biased) sample that suffers from practical, unavoidable limitations when applied to statistical analysis. Two, stumpage prices cannot be generalized across markets. Like timber markets in practice, stumpage prices reflect a snapshot of uniquely local circumstances. Analyzing timber markets for investment purposes is a localized, situational exercise.

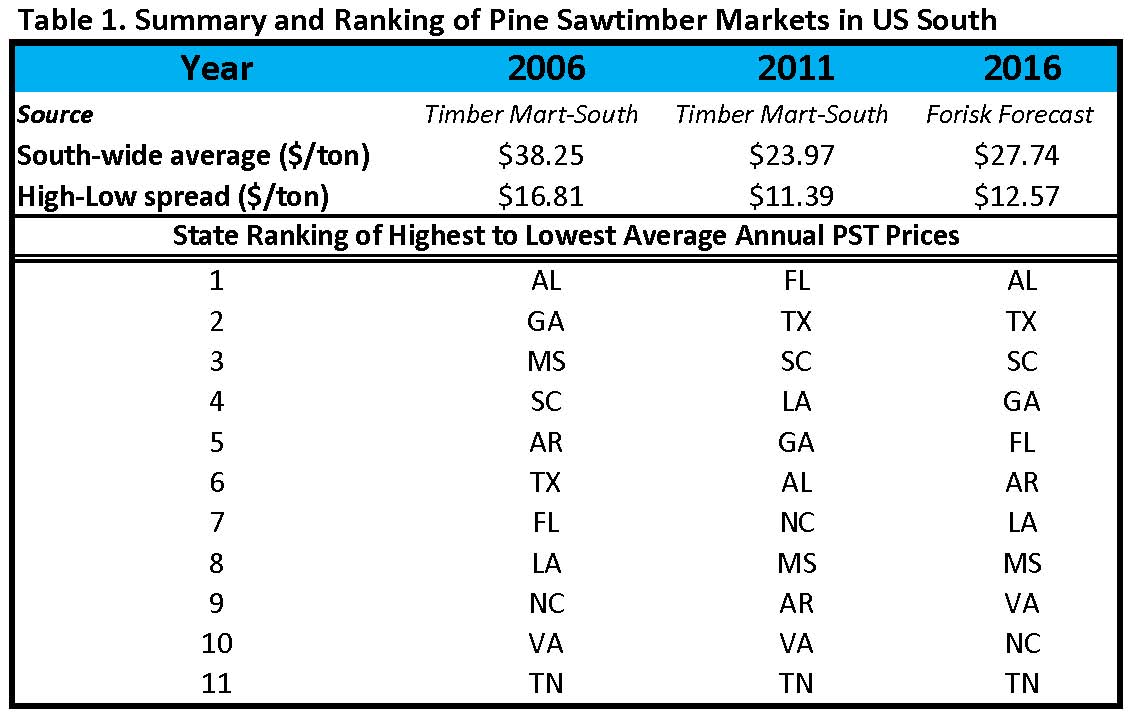

Consider the disparity of historic and forecasted pine sawtimber prices across markets in the US South over time (Table 1). The wide ranges of prices (High-Low spread) across states in the past translate into broad ranges of estimated prices across states in the future. We have used stumpage price data from dozens of public and private sources, and all have limits. When applying third-party stumpage price data, we want to know, for example, (1) how well the price series reflects realized changes over time and (2) how well the series reflects price levels over time. These are two different questions that speak to the coverage, consistency and biases imbedded in the data.

My paranoia related to stumpage price data extends to analysis delivered by stumpage price providers. Whether or not analysis is rigorous and statistically valid, research that relies on one’s own data, when other data sets are readily available for further market testing, is biased and incomplete. That’s just the way it is, by definition and by practice.

What about stumpage forecasts? Forecasting helps identify relationships in historical data to infer future conditions. A forecast tells a story, a view of how the market functions. Since stumpage forecasts could compound the limitations of stumpage price data, perhaps forecasting is a fool’s errand. However, the mystical status of forecasting discounts the primary importance of prudent analysis, focused objectives, and rigorous implementation.

In theory, building a forecast is straightforward. Plug into the Matrix and ask the Oracle. (She’ll bake you some cookies and tell you not to worry about breaking the vase. Then she will tell you we don’t forecast to make decisions, we forecast to justify decisions already made…..) In practice, it’s a disciplined analytic exercise to test ideas, data and assumptions. Properly collecting and understanding the strengths and limitations of the data are as important as any aspect. Without testable, useful, reliable data, quantitative analysis would suffer and, once exposed, wither in a sea of scornful questions.

Forisk will teach “Timber Market Analysis” on August 15th in Atlanta, a one-day course for anyone who wants a step-by-step process to understand, track, and analyze the price, demand, supply, and competitive dynamics of local timber markets and wood baskets. For more information, click here.

1. Does a forecast tell a story “of how the market functions,” or how it might function at a specified time in the future or through future time up to a specified stopping point in time?

2. Are you asserting that forecasting “discounts the primary importance of prudent analysis” et cetera or that the mystical status of forecasting does so? Or are you asserting that much of what passes for forecasting is imprudent, unfocused, and sloppy?