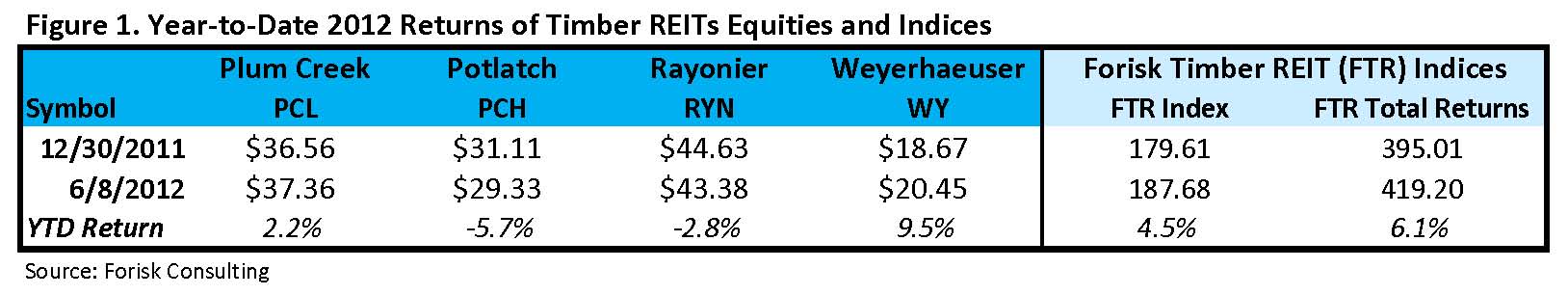

Recent rosiness reported in US housing markets triggered interest and trading in public timber REITs. Year-to-date, timber REITs and the Forisk Timber REIT (FTR) Index show positive performance (Table 1). However, the results vary by firm and sit below 2012 peaks in March and April and May, replaying a scenario where investors capture profits opportunistically. In sum, equity markets priced in the good news and shareholders shed shares to book the gains.

We have seen this story before. In 2008, Forisk published the first peer-reviewed research evaluating timber REIT performance (“Investor Responses to Timberlands Structured as Real Estate Investment Trusts (REITs)” in the Journal of Forestry; for a copy, email Heather Clark at hclark@forisk.com). The study analyzed equity market responses to announcements by forest industry firms of their decisions to restructure from traditional C-corporations to real estate investment trusts (REITs). Our research found that all four announcements were associated with significant abnormal increases in the stock prices. On average, shareholders showed a 5.2% paper gain in share value one day following the announced intent to convert. The analysis concluded that investors prefer holding industrial timberlands within a REIT – with its tax efficient structure and distribution requirements – rather than traditional C-corporation. In addition, in three out of four cases, investors took this sudden bump in stock prices as an opportunity to extract near-term profits.

Finally, the current increase in timber REIT prices is consistent with Forisk’s January 2011 firm-by-firm analysis ranking the potential upside for timber REITs (”Comparative Analysis of Timber REIT Forest Harvesting Activities: Who Wins as Housing Markets Return?”). While less than 50% – in cases, much less – of firm revenues derive from timber sales, direct exposure to housing – as measured by revenues from Timber, Wood Products and Homebuilding segments – exceeds 60% of revenues for three of four REITs. Specifically, we noted that Weyerhaeuser will lead on an aggregate and relative basis and Rayonier retains the greatest potential for increasing mix-driven margins from timber harvesting. Thanks to their liquidity, investments in public timber REITs have tremendous exposure to the moods of market.

For investors and analysts tracking wood and timber REIT markets, Forisk offers “Timber Market Analysis” on August 15th in Atlanta, a one-day course for anyone who wants a step-by-step process to understand, track, and analyze the price, demand, supply, and competitive dynamics of timber markets and wood baskets. For more information, click here.

Leave a Reply