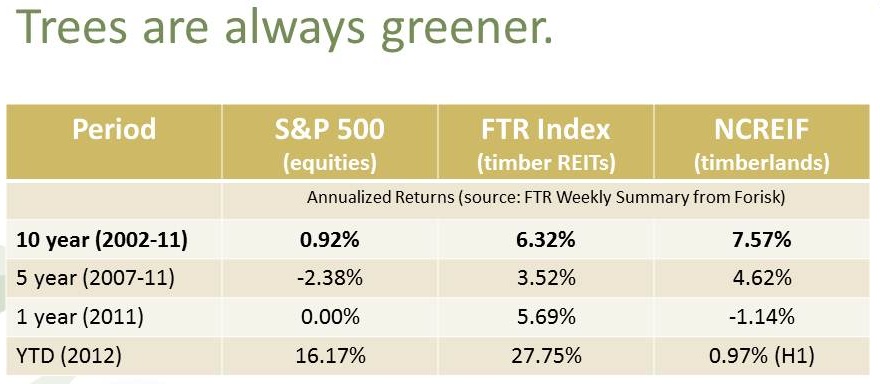

In forestry and timberland investing, sometimes our job is to get out of our own way. In other words, let the forestry asset do what it’s going to do for us given it’s inherent exposures to housing and pro-cyclical financial performance. Year-to-date and over the past ten years, publicly-traded timberland-owning firms (timber REITs) outpaced the S&P 500, while private timberland investments led even timber REITs for the ten year investment period (figure).

Reflecting on alternate timberland investment vehicles in an improving post-recessionary environment, we can reaffirm key advantages delivered by the asset class. Positive cash flows. Portfolio diversification. Optionality. Meanwhile, the risk profile for the sector has changed. New investors face limited downside in their portfolios to the physical risks of insects, disease, fire and weather events, but struggle to quantify the risks associated with shifting forest certification and regulatory expectations.

For FTR calculation methodology, please visit www.forisk.com and click on “Equity Research.” To subscribe to the free FTR Weekly Summary, or for information regarding Forisk Equity Research, please contact Brooks Mendell, bmendell@forisk.com.

Leave a Reply