CatchMark Timber Trust (CTT), formerly the private Wells Timber REIT, became a publicly-traded timberland-owning REIT on the New York Stock Exchange effective December 12, 2013. CatchMark’s IPO represents a pure, and path-breaking, “private-to-public” timber play. Investors and timberland investment managers, especially those affiliated with private timber REITs rather than “funds” or separate accounts, now have a ticker to track while gauging the actual-versus-perceived arbitrage in private versus public timberland valuations.

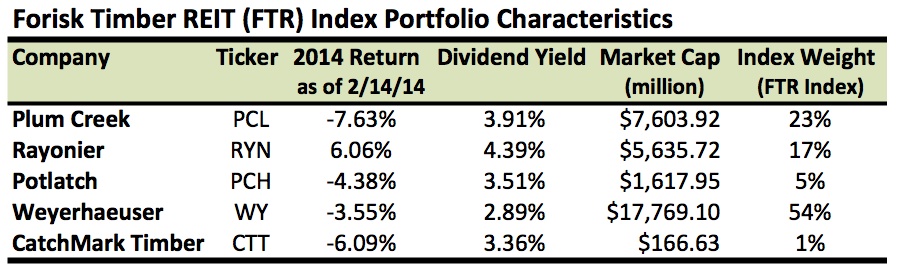

In February 2014, CatchMark joined the Forisk Timber REIT (FTR) Index retroactive to its December 12, 2013 initial public offering. The FTR Index is a market capitalization weighted index of all public timber REITs; it provides a benchmark for a subset of institutional and retail timberland investors, particularly those interested in tax efficient REIT structures. In addition to CTT, the FTR Index includes Plum Creek (PCL), Rayonier (RYN), Potlatch (PCH), and Weyerhaeuser (WY).

CatchMark is small. With a market cap below $170 million, it accounts for ~1% of the five-firm FTR Index (Table). Previously, Potlatch was the smallest timber REIT, with nearly 1.5 million acres of US timberlands. In comparison, CatchMark owns and leases approximately one-fifth this total.

For detailed, historic FTR Index data in Excel and to be added to the free FTR Weekly Summary distribution, please contact Heather Clark, hclark@forisk.com, (+1) 770.725.8447.

Leave a Reply