This post includes excerpts from Forisk’s timberland investment research and Brooks Mendell’s September 2014 presentation at the “Who Will Own the Forest?” conference in Portland, Oregon. The complete presentation is available here.

During the ten-year period from January 2004 through December 2013, annualized returns for timberland investments – both direct ownership (8.4%) and equity plays in public timber REITs (9.4%) – outperformed the broader stock market (5.2% for the S&P 500). Basically, timberland investments provided the desired stability and diversification through a distressing economic cycle.

Fees, of course, also matter. Index fund pioneer and Vanguard founder, John Bogle, said, “You get what you don’t pay for.” His message: minimize fees. Our conversations with institutional investors and conference organizers indicate a perceived misalignment of timberland management fees relative to prospective timberland returns. What does the “data” say with respect to this perception?

The fees and costs differ for direct timberland ownership versus shares in public timberland-owning firms. Reported returns from public timber REITs, as with any public stock, already account for “management fees”, while those associated with private timberlands as reported by the National Council of Real Estate Investment Fiduciaries (NCREIF) normally do not. However, in the past few years, NCREIF began reporting fund level “gross” and “net” returns that allow us to estimate fees paid for timberland asset management services.

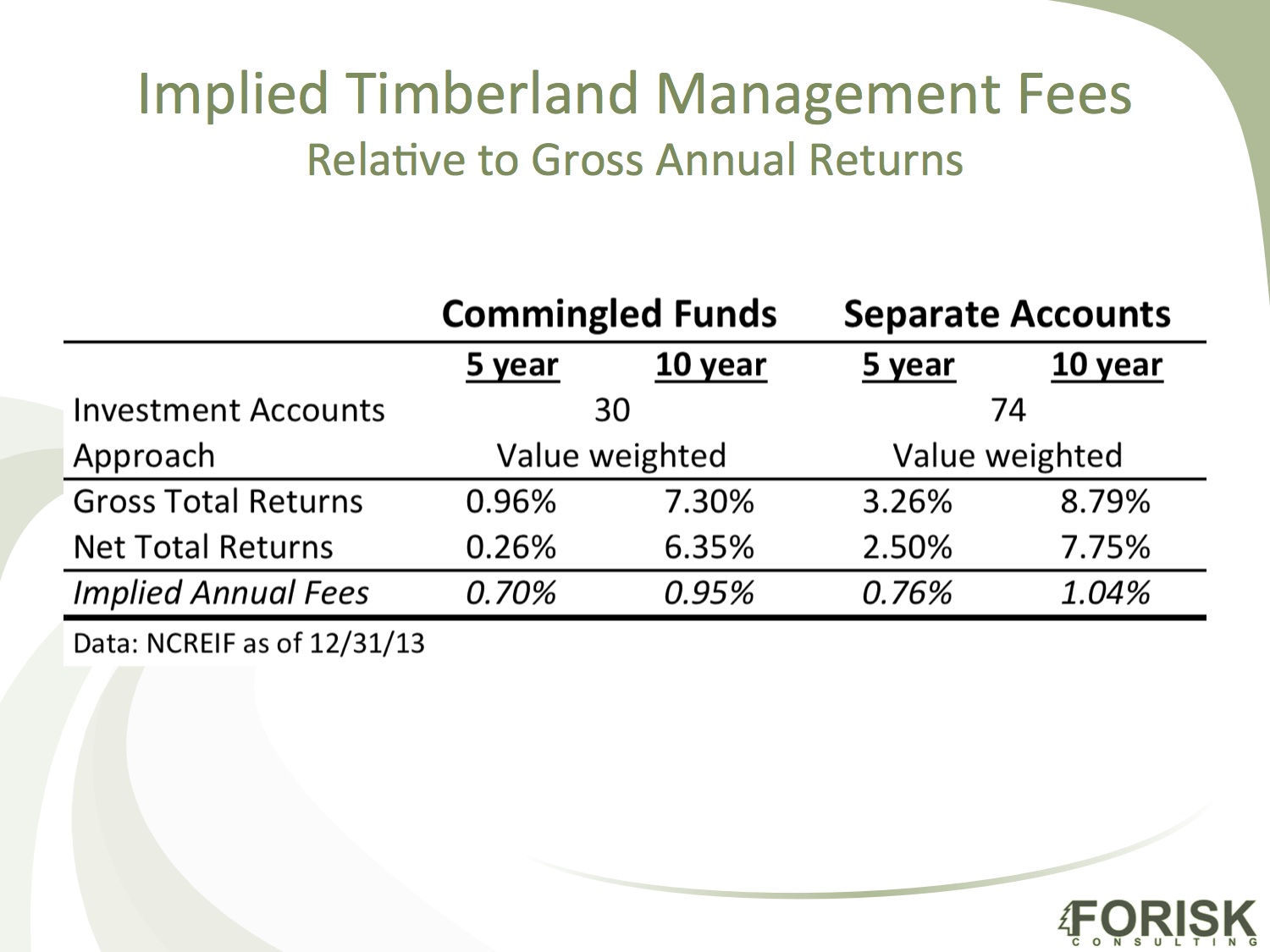

The table below includes data from 11 TIMOs covering 11.9 million acres of private timberlands in the United States. The analysis separates commingled funds, which pool investments from multiple investors, from separate accounts, which manage funds from specific institutions separately. The “net” returns subtract all investment management advisory fees, including paid and unpaid performance incentive fees.

The implied annual fees are consistent with Forisk analysis of prospectuses and contract structures, which find that TIMO incentive pay representing an “overage” or “carried interest” of 10 to 20% above a hurdle of 7 to 8% nominal is common. In addition, the implied fees are consistent and in line with ranges reported by Mercer at WWOTF for other non-timber asset classes. Specific to timberland, Forisk research found average total fees from 2005 through 2012 of 84 basis points.

Leave a Reply