This post includes an excerpt from a feature article in the Q3 2015 Forisk Research Quarterly (FRQ) written by Amanda Lang, Brooks Mendell, and Bob Abt.

In this article, we explore the relationship between two housing start scenarios and timber supplies for the U.S. South and local timber markets over the next 25 years. The Base Case, which represents our “most-likely” scenario, uses Forisk’s Base Housing Starts Outlook. The Low Case assumes 10% less pine grade demand in the South. This equates to ~2.6 million fewer housing starts and ~112 million fewer tons of pine grade harvested between 2015 and 2024 than in the Base Case. Final results (1) reinforce how forests continue to grow and (2) provide localized market rankings for pine grade and pulpwood supplies.

Pine grade supplies in the South increase in both forecast scenarios, beyond levels seen in recent history. Higher grade demand in the Base Case results in inventories that are 40% higher in 25 years than current inventories. The Low Case results in inventories that are 48% higher than current inventories by 2040. How does this relate to what happened during the recession?

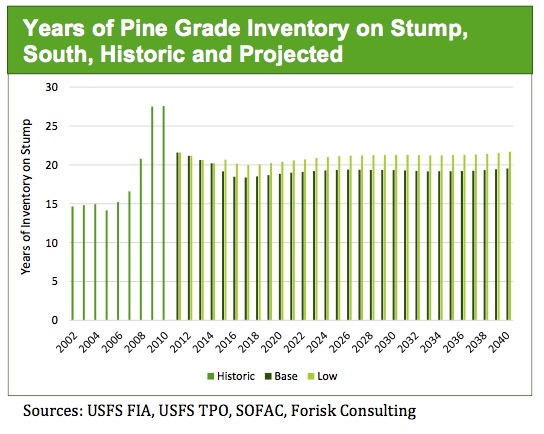

In the 2000s the South averaged 15 years of pine grade inventory on the stump (inventory relative to removals; Figure). The recession reduced grade demand, which led to reduced harvesting and increased inventories. As a result, the years of “relative” inventory increased to 28 in 2009 and 2010. Increased harvesting since then reduced standing inventory relative to removals, but projections indicate that the South will average 19 years in the Base Case (21 years in Low Case). The recession effectively re-set the “normal” baseline relationship of supplies to removals in the South.

Product specific analysis shows how effects of the recession on pine grade and pulpwood supplies far outstrip the effects of the housing starts scenarios. The Base and Low projections require six years before generating noticeable pine inventory differences (over 2% difference in 2021). This reinforces how the forest we have today drives the first 5 to 10 years of any supply projection. Acres cycling through harvesting and replanting form the new supply of pulpwood and sawtimber.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply