This is the second in a series related to Forisk’s Q4 2015 forest industry analysis and timber price forecasts for the United States.

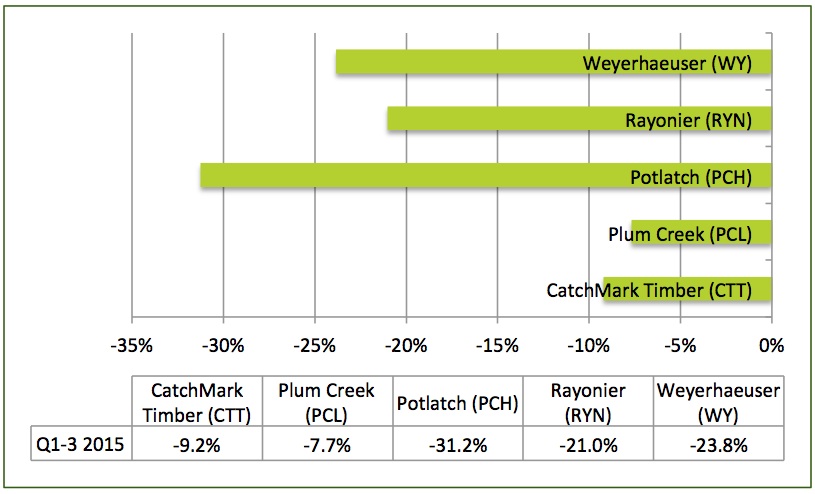

Through Q3 2015, all five public timber REITs traded at prices below where they started the year on January 1. In 2014, the Forisk Timber REIT (FTR) Index showed positive returns because Weyerhaeuser, the only firm with meaningful positive stock price appreciation that year, accounts for 57% of the timber REIT sector’s market capitalization. However, share prices through Q3 2015 highlight the exposure of the sector to modest recovery rates in housing and lumber, along with uncertainty associated with exchange rates and softwood lumber trade with Canada. Through Q3 2015, the timber REIT sector generated returns of -18.8% (Figure).

2015 Public Timber REIT Share Price Performance Thru Q3

The question for investors remains, “is this a buying opportunity?” Are current prices a trick or a treat? Systematically valuing timber REITs over time triggers our abilities to buy (and hold) timber REIT stocks at attractive prices. The key challenges for REIT investment analysis are (1) having a method for assessing when timber REITs are over or underpriced relative to firm asset value and (2) having a method for assessing when timber REITs as a sector are over or underpriced relative to other REITs or the overall stock market.

During the October 8th “Investing in Timberland and Timber REITs” course in Atlanta, we walked through a case study to value CatchMark Timber using multiple approaches. While the group enjoyed a robust discussion, even conservative assumptions indicated shares were undervalued. [The Q4 Forisk Research Quarterly (FRQ) details this process for all five public timber REITs to estimate current net asset values (NAVs).]

A clear understanding of how and where wood-using capacity is spatially configured throughout North America remains the critical starting point for adjusting timberland values. These adjustments, in the form of end market and local-specific recovery rates for wood demand and timber prices, tell different stories for each timber REIT based on each firm’s timberland “footprint” in the United States. In the end, we have first order and second order priorities when valuing these timberland investment vehicles, and clarifying these priorities simplifies the valuation process.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Quite a conundrum for the extremely small and elite industrial and institutional timberland appraisal community. This ever begs the looming question, what percentage of the revenue stream of such appraisal shops are derived from the REIT’s and TIMO’s …and…are such shops tied in directly or indirectly with related timberland management and consulting shops, further overshadowing the appraisal process? Suivre l’argent. Cui bono. Or, simply, follow the money.