This is the fourth in a series related to Forisk’s Q4 2015 forest industry analysis and timber price forecasts for North America.

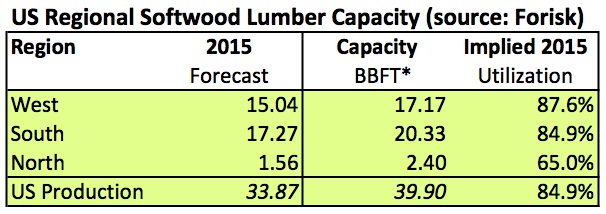

Localizing the capacity of softwood sawmills to consume wood translates into robust estimates of regional and national capacity. Regardless of the macroeconomic assumptions for housing starts, specific mills in specific markets must produce the boards. Are they out there and ready to go? Where? For example, for softwood grade markets in the US South, US North, US Pacific Northwest and Canada, we aggregate mill-by-mill analysis with assessments of announced capacity changes to estimate total available lumber capacity. The table below includes the current baseline number for the United States as of the Q4 2015 Forisk Research Quarterly (FRQ).

These estimates rely on the “physical facts” associated with actual mill capacities. In projecting production, we cap demand increases at mill capacity, plus announcements, with a 5% tolerance. These capacities become constraints in local timber price models, forcing us to take positions on where new mills might be built or existing mills expanded. In quarterly work sessions, our team tests and agrees on viable pathways for projected softwood lumber production. The thinking prioritizes (1) operable closed capacity that could reopen; (2) markets with well-established infrastructures that can better absorb new demand; and (3) well-supplied markets that remain far below their historic production levels.

For North America, critical analysis includes Canada’s softwood lumber industry. What is Canada’s ability to manufacture and export softwood lumber to the United States? In theory, more Canadian production leads to less production and lower prices for U.S. sawmillers and lower log prices for U.S. timberland investors. In practice, the physical facts of Canada’s softwood sawmill industry have changed.

Forisk’s research into North America’s wood-using capacity, as of August 2015, included detailed confirmation of 69% of Canada’s open sawmill capacity and 91% of Canada’s idled and closed softwood sawmill capacity. The results of this ongoing research indicate that Canada’s maximum softwood lumber production, assuming all open and idled mills operate at 100%, is 30.6 billion board feet, or nearly 20% less than ten years ago.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply