Timber REIT shares suffered with the S&P 500 during two weeks of bubble-bursting activity to open 2016. Through January 15th, the S&P dropped 8% while the public timber REITs scored as follows:

- CatchMark (CTT): -1.5%

- Plum Creek (PCL): -13.5%

- Potlatch (PCL): -15.0%

- Rayonier (RYN): -11.6%

- Weyerhaeuser (WY): -13.9%

Of the timber REITs, only CatchMark Timber has outperformed the S&P 500 and avoided a sell-off. Overall, per the Forisk Timber REIT (FTR) Index, the timber REIT sector is down 13.4% for the year. Happy New Year.

The recent selloff did generate questions about Plum Creek’s announced merger with Weyerhaeuser from early November. Is this a done deal? Is it too early to worry about seating arrangements at the wedding reception? In fact, is it really too late to woo the bride-to-be?

In a joint proxy dated December 28, 2015, Weyerhaeuser CEO Doyle Simons and Plum Creek CEO Rick Holley outlined the terms of this arrangement:

“If the merger is completed, Plum Creek shareholders will have the right to receive 1.60 Weyerhaeuser common shares for each share of Plum Creek common stock…The exchange ratio is fixed and will not be adjusted to reflect stock price changes prior to the completion of the merger…We urge you to obtain current market quotations of Weyerhaeuser common shares and shares of Plum Creek common stock.”

The proxy letter also notes that, as of November 6, 2015, the last trading day prior to the merger announcement, the 1.60 ratio valued Plum Creek at $48.64 per share. That implies a 20.7% premium for Plum Creek shareholders relative to where shares closed that day.

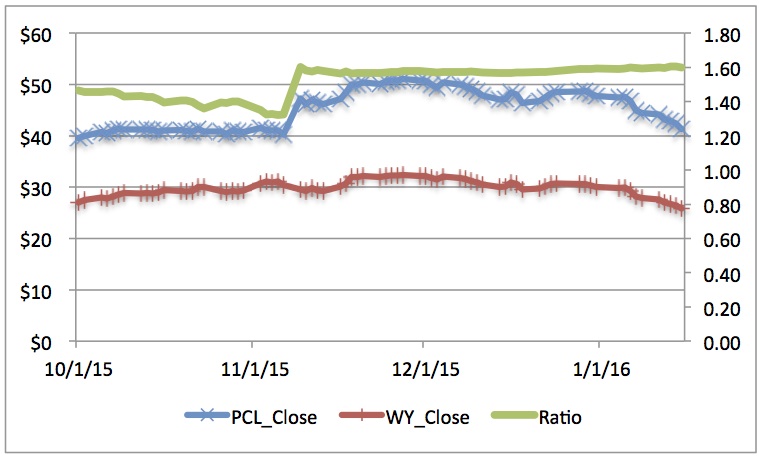

So where are we today? Are there arbitrage opportunities? The figure below plots PCL and WY share prices for Q4 2015 through the first two weeks of 2016 along with the calculated PCL-to-WY price ratio (plotted on the second Y-axis). Since November 9, 2015, shares have traded firmly at a ratio between 1.57 and 1.60. For 2016, shares closed at 1.59 or 1.60 each of the ten trading days.

PCL and WY Share Prices and PCL-to-WY Share Price Ratio

Friends and family believe this marriage is a done deal. They’re just waiting for invitations to arrive so they can hold the date. In short, the data indicates that traders are enforcing the ratio. How would Plum Creek’s shares perform today if unhinged from this 1.60 ratio?

To subscribe to the free weekly FTR Index Summary and to obtain historical FTR Index data in an Excel format, please sign up here or contact Heather Clark at hclark@forisk.com.

Leave a Reply