This post summarizes research published in the Q1 2016 Forisk Research Quarterly (FRQ) Publication tracking investment activity and capacity reductions in the U.S. pulp/paper sector.

Recent mill upgrades and closures mirror Forisk production forecasts; the pulp and paper sector is changing, not retiring.

Projected production in the packaging and household/sanitary categories parallel investments made in facilities producing these products. In addition, mill closures at printing and writing paper manufacturers support forecasted declines in the category. The good news for timber investors is that overall demand for wood used to make pulp for paper declines negligibly, if at all in the next 10 years. Reduced demand for pulpwood from projected declines in newsprint and writing paper production is offset by projected increases in paperboard production. This is true regionally; however, local timber market effects may vary based on the mills in the area.

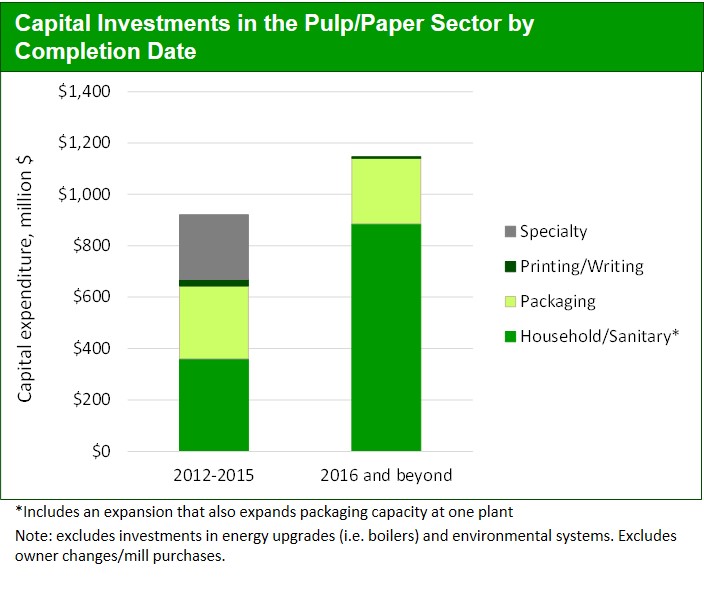

Household and sanitary investments attracted the most capital in the pulp and paper sector.

Pulp and paper mill upgrades made between 2012 and 2015 totaled $0.9 billion and included investments in household/sanitary products, packaging, and specialty papers. In 2016 and beyond, 77% of announced upgrade projects occur within the household and sanitary category.

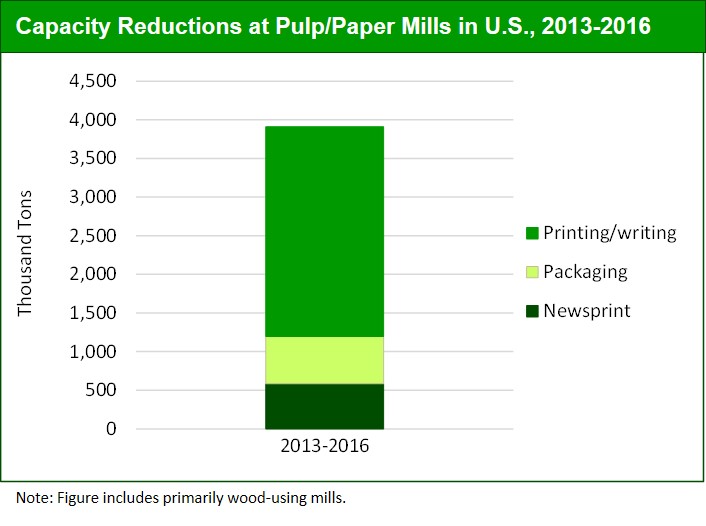

Pulp and paper mill closures and capacity reductions in the U.S. reduced annual output by over 3.9 billion tons from 2013-2016.

Newsprint and printing and writing paper accounted for 84% of reductions, which tracks reduced demand for pulpwood in these sectors. WestRock’s decision to close mills in Coshocton, Ohio and Newberg, Oregon contributed to the decline in packaging production. According to WestRock, the closures were part of a strategic restructuring to better align supply with consumer demand.

Within the writing and printing paper category, the state of Maine was hit hardest with over half of the closures and capacity reductions occurring in this state. Factors cited as contributing to Maine mill closures include the increased value of the U.S. dollar over the Canadian dollar, the high cost of wood within the state, and a decrease in market demand for printing and writing products.

Forisk intern Chantal Tumpach supported the research for this blog post.

Leave a Reply