This is the third in a series related to Forisk’s Q2 2016 forest industry analysis and timber price forecasts for the United States. This post includes an excerpt from the “Forisk Facts and Figures” from the Q2 2016 Forisk Research Quarterly publication.

The Q2 “Forisk Facts and Figures” details structural panel mill capacity by region in the U.S. for the past 25 years. Forisk tracks mill-by-mill capacity by sector for the U.S. to assess trends in capital allocation and wood use by region. How has the mill infrastructure to produce structural panels changed in the past 25 years, and how does it vary by region across the U.S.?

The OSB sector reallocated capacity to the South since the Recession: 2.0 billion square feet of capacity shifted from the North to the South since 2005. OSB capacity increased from 6.2 billion square feet in 1990 to 18.2 billion square feet in 2007 (194%). Capacity fell 18% to 15.0 billion square feet in 2009. Recovery has been modest as the sector increased capacity 9% to 16.3 billion square feet in 2015 (2005-2006 levels). Utilization averaged 92% from 1990-2007; for the past three years, utilization increased from 78% in 2013 to 81% in 2015.

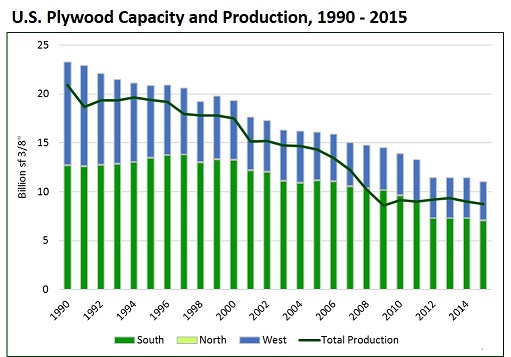

Post-recession, the plywood sector reallocated capacity to the West: 700 million square feet of capacity shifted from the South to the West since 2009 (Figure). Plywood capacity has fallen the past 25 years: it decreased 53% from 23.2 billion square feet in 1990 to 11.0 billion square feet in 2015. The sector has not increased U.S. capacity since the Recession; in fact, capacity has been flat for the past four years. Utilization averaged 90% in the 1990s and averaged 88% in the 2000s (pre-recession). For the past three years, utilization decreased from 82% in 2013 to 79% in 2015.

This mill capacity research supports analysis of wood markets and timber prices, and will be published with the Q2 Forisk Research Quarterly (FRQ). To learn more about the FRQ, click here or contact Brooks Mendell at bmendell@forisk.com, 770.725.8447.

Forisk intern Chantal Tumpach supported the research for this blog post.

Leave a Reply