This post includes an excerpt from the bioenergy research published in the Q2 2016 Forisk Research Quarterly (FRQ) Publication.

U.S. wood bioenergy project announcements have slowed, but the wood bioenergy outlook remains stable for the U.S. Wood bioenergy failures continue to out-pace successes.

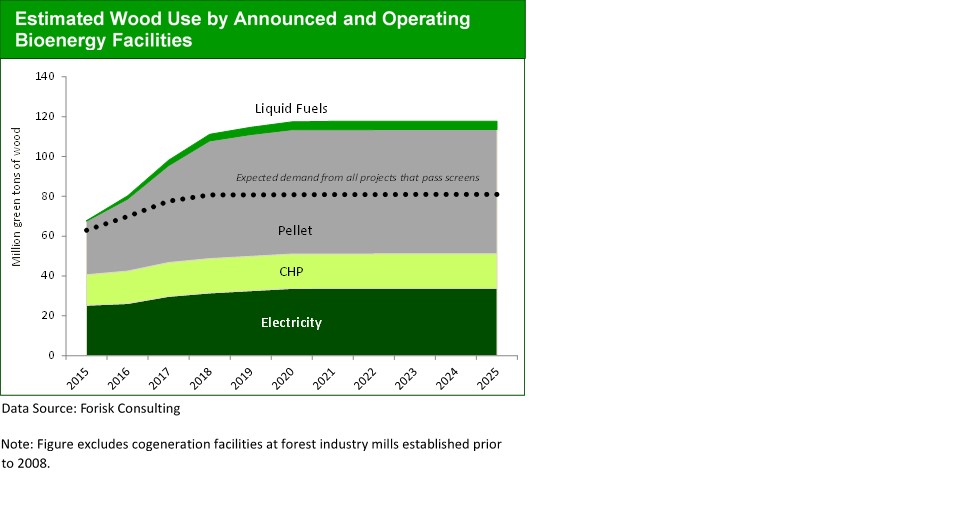

The figure below details estimated wood use associated with bioenergy, by project type, in the United States through 2025. The “estimated demand from all projects,” as represented by the dotted line, reflects the application of Forisk’s screening of all 432 operating and announced projects tracked in Forisk’s wood bioenergy database as of April 22, 2016. This is down from 433 projects as of February 3, 2016. These projects represent potential wood use of 118.2 million tons per year by 2025. Based on Forisk’s analysis, 295 projects—representing potential wood use of 80.9 million tons per year—pass basic viability screening.

U.S. wood pellet capacity continues to increase with export oriented projects driving the growth.

Regionally, the U.S. North still has the largest share (46%) of viable wood bioenergy projects while the South accounts for 53% of the potential wood use for bioenergy. Pellet projects, planned and under construction, remain the largest source of growth in U.S. wood bioenergy markets. This growth is driven by export oriented projects.

Exports of U.S. wood pellets increased through February 2016 over the same period in 2015 and are on pace to surpass 4.8 million metric tons. This represents a 5.1% increase over 2015 export volumes. The market share of exported U.S. wood pellets continues to consolidate. The United Kingdom imported 83.4%, 668 thousand metric tons, of all U.S. wood pellet exports in 2016 through February. Belgium, the second largest importer through February 2016, imported 14.4% of U.S. wood pellets. These two countries alone accounted for 97.7% of all U.S. wood pellet exports in 2016.

To download the most recent Wood Bioenergy Summary, click here.

Very useful information.