This is the fourth in a series related to Forisk’s Q3 2016 forest industry analysis and timber price forecasts for North America.

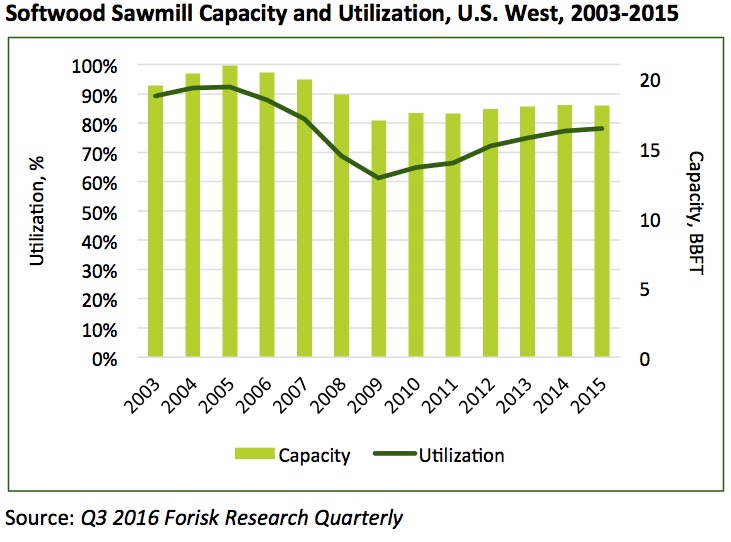

Coastal markets in the Pacific Northwest include 68 open sawmills that can consume over 44.8 million tons of conifer logs. Softwood sawmill capacity utilization in the Pacific Northwest increased for the sixth consecutive year (Figure). Utilization was 78% in 2015, the highest level since 2007. Total capacity is still 13.7% lower than the 2005 peak. And firms continue to announce investments in sawmill infrastructure ($212.5 million in 2015-2019).

Coastal Oregon accounts for 86% of softwood plywood capacity in the Northwest’s Coastal markets. While Oregon leads the Northwest in plylogs, Washington State leads the U.S. in log exports. Annualized log exports in Washington currently track 2% above 2015 levels; Oregon log exports are up 12% relative to 2015.

The terrain and weather challenges in the West necessitate a diversity of harvesting systems with differing costs and productivities. The total sawtimber inventory is greater in Coastal Oregon than Coastal Washington because the supply located on steeper slopes, accessible by higher cost cable yarding or cable-assisted ground based logging operations, is greater in Oregon (20 BBFT) than Washington (12 BBFT). Regional average logging and hauling costs in the Pacific Northwest region are projected to grow at less than 1% per year over the next decade due to slow diesel cost increases.

The premium paid for log exports over domestic sawlogs over the past four quarters for Douglas-fir exceeded the five-year average. Domestic and export prices for Douglas-fir and Hemlock correlate strongly, although Douglas-fir #2 prices are more correlated than Hemlock. Average delivered log prices for 2016 are forecast to increase 1.3-1.7% in nominal terms across products when compared to the last 4-quarter average prices.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Diesel prices are not the only variable affecting logging cost – labor supply(most notably truckers and ground crew), workers comp rates and cable logger availability are significant factors.