This post includes an excerpt from the bioenergy research and featured research authored by Amanda Lang and Andrew Copley published in the Q3 2016 Forisk Research Quarterly (FRQ) Publication.

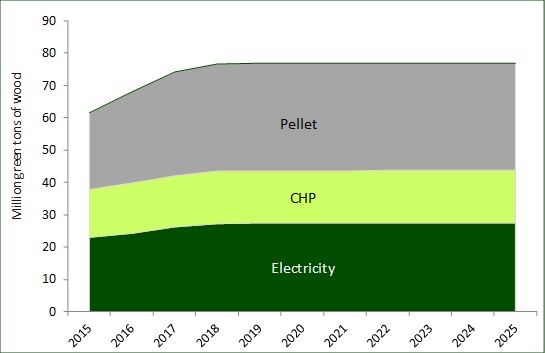

Forisk analysis suggests wood use for viable bioenergy projects in the U.S. will be 77.7 million tons per year by 2025.

As of July 22, 2016, Forisk’s wood bioenergy database tracks 434 operating and announced projects, up from 432 projects in April 2016. These projects represent potential wood use of 116.6 million tons per year by 2025. Based on Forisk analysis, 291 projects pass basic viability screening associated with technology and project development milestones, indicating potential wood use of 77.7 million tons per year. This is down 4% from the April 2016 estimate. The figure below details estimated wood use by bioenergy projects in the United States that pass our screens through 2025.

Estimated Wood Use by Operating and Announced Bioenergy Projects that Pass Forisk’s Viability Screens

Note: Figure excludes cogeneration facilities at forest industry mills established prior to 2008.

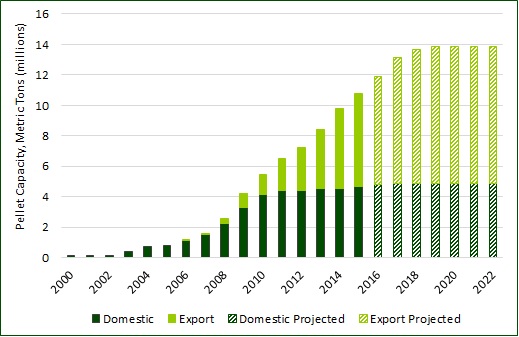

Despite challenging global markets, U.S. wood pellet capacity continues to increase with export oriented projects driving the growth.

Based on pellet project announcements, U.S. pellet capacity was 10.8 million metric tons (mt) in 2015. Of this capacity, 57% served export markets, and 43% went to U.S. home heating. Most projected growth in U.S. pellet capacity is from export-oriented projects.

U.S. Pellet Production Capacity Projection

Note: Projection only includes projects that pass viability screens.

The growth of the North American wood pellet trade has slowed from its initial surge between 2009 and 2014. Europe remains the largest importer of both U.S. and Canadian wood pellets. Of the 2016 YTD volumes, 89% of U.S. exports and 74% of Canadian exports are destined for the U.K. Forisk projects global demand for industrial wood pellets to grow 87% in the next five years, with demand for U.S. wood pellets growing 91% by 2020. Despite these large growth rates, this represents a decrease in demand for U.S. wood pellets compared with Forisk’s projections one year ago. Primary decreases are associated with lower projected UK demand and a revised assumption of the U.S. market share of Denmark’s demand. Construction of additional pellet plants in the U.S., beyond those currently announced, is unlikely as this capacity, coupled with shuttered capacity, can satisfy projected 2020 demand for U.S. pellets.

More can be found in the Q3 2016 FRQ feature article North American Pellet Capacity: How Will It Develop Over the Next Ten Years?, which includes policy analysis, capital investments and a breakdown of pellet use by country. To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447. To download the most recent Wood Bioenergy Summary, click here.

Leave a Reply