By Brooks Mendell and Amanda Lang

This is the second in a series related to Forisk’s Q4 2016 forest industry analysis and timber price forecasts for the United States and Canada.

In October 2015, the Softwood Lumber Agreement (SLA) between the United States and Canada expired. Now in October 2016, a one-year freeze on tariffs that prevented the filing of any trade complaints expired. U.S. lumber producers want a cap on Canadian exports, while Canadian producers want to enact an agreement similar to the 2006 SLA. The previous agreement implemented an export tax when the benchmark lumber price in the U.S. fell below $355/MBF.

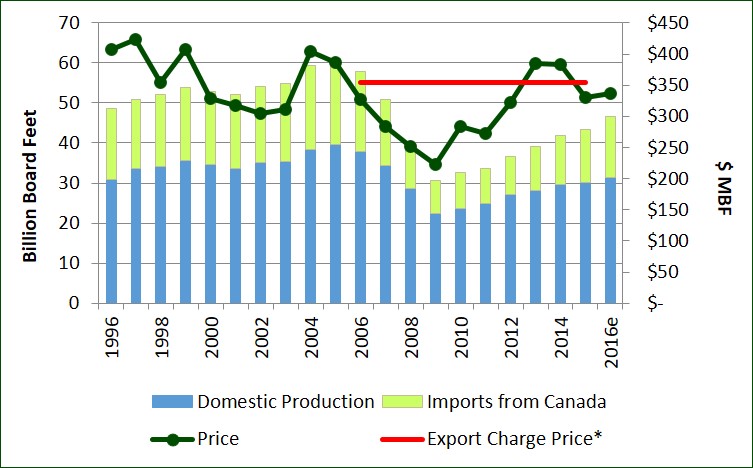

Since 2006, net lumber imports from Canada declined from over 36% of U.S. softwood lumber consumption down to 26% in 2011. Now it ranges between 25% and 28%. This spiked to 31% mid-year, worrying U.S. lumber producers. Since October 2015, lumber prices have been below the $355/MBF export charge price for 9 of the past 11 months for which we have data (Figure 1). If the former agreement were still in place, the U.S. would have collected export taxes for those 9 months.

Figure 1: U.S. Softwood Lumber Price and Consumption by Source

*Export charge on Canadian imports in effect when benchmark price <$355/MBF; calculated monthly with taxes implemented on a sliding scale relative to Random Lengths pricing. Figure shows annual average softwood lumber price; does not account for months that triggered, reduced or rescinded taxes. Data sources: WWPA, Statistics Canada, Random Lengths.

Moving forward, what impacts might the expiration of the Softwood Lumber Agreement and increased Canadian lumber imports have on U.S. lumber producers and timberland owners? Let’s review the facts:

Fact one: Canada no longer has the physical capacity to produce and import softwood lumber at levels reached from 1999 through 2007 while also meeting domestic (Canadian) demands. Canada’s ability to manufacture softwood lumber and harvest softwood logs has declined: the housing market collapse coincided with rippling effects from the Mountain Pine Beetle on Canadian softwood forest supplies. This period of time coincided with major investments by Canadian forest products firms in the U.S. South. Since 2006, Canada’s softwood lumber capacity shrunk ~20%.

Fact two: Exports to other countries from Canada are down now. Through July, Canadian exports to the U.S. were up 22% since July last year. Exports to China were down 13% and exports to Japan were down 5%. Canada has diverted exports from China and Japan to the U.S. If Canada increases offshore exports, then exports to the U.S. will decline.

Fact three: Canada’s housing starts are also down. Canada’s domestic use of lumber is at the same level as last year, with no growth. If (and when) Canada’s housing starts increase, exports to the U.S. will decrease.

Fact four: our outlook for the U.S. housing market has just been revised down and continues to develop slower than expected. As housing starts approach 1.5 million as projected, the effect of Canadian imports on U.S. producers will decline.

The bottom line – so what? : Increased Canadian exports of lumber to the U.S. are taking market share from U.S. producers. Currently, the three key levers driving this – Canadian exports to other countries, Canadian domestic demand for its own homes, and U.S. housing markets – are all working against U.S. lumber producers, magnifying the effect of Canadian imports. Any change in direction in any of these levers reduces the impact on U.S. markets, reinforcing that view of this as a “short-term” crunch until housing markets improve in the U.S. and Canada.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply