Economists surveying the landscape following the 2016 US Presidential Election expect trade wars, economic growth and higher inflation. For me, this raises two questions. One, do the expectations of these analysts matter? That’s the performance question, and the track record is murky at best. Two, however, if the expectations materialize, what do they imply for timberland investments and timber REITs?

First, let’s recap how timberland investments have performed recently. The Q4 2016 Forisk Research Quarterly (FRQ) summarized the performance of timberland investments and public timberland-owning firms across a series of time periods. Private timberlands returned 1.4% through Q3, according to NCREIF. Public timber REITs returned 4% as a group YTD through October, as compared to -9% in 2015, according to the Forisk Timber REIT (FTR) Index. Two of the four timber REITs have positive mid-year returns, led by Potlatch (PCH) and Rayonier (RYN). Another publicly timberland owner, Pope Resources (POPE), also shows positive returns for 2016.

What do we know about timberland investments and rising inflation? As we’ve discussed previously, academic studies indicate that timberland investments may hedge against unexpected inflation. The seminal academic paper in this area, “Do Forest Assets Hedge Inflation?” by Court Washburn and Clark Binkley (Forest Science, August 1993), asserted that timberland assets, especially those in the Pacific Northwest and South, hedge “higher-than-anticipated inflation.” In 2007, forest economist Jack Lutz affirmed a positive correlation between timberland returns and inflation, concluding that timberlands will “preserve capital in the face of rising consumer prices” (Forest Research Notes, Q3 2007).

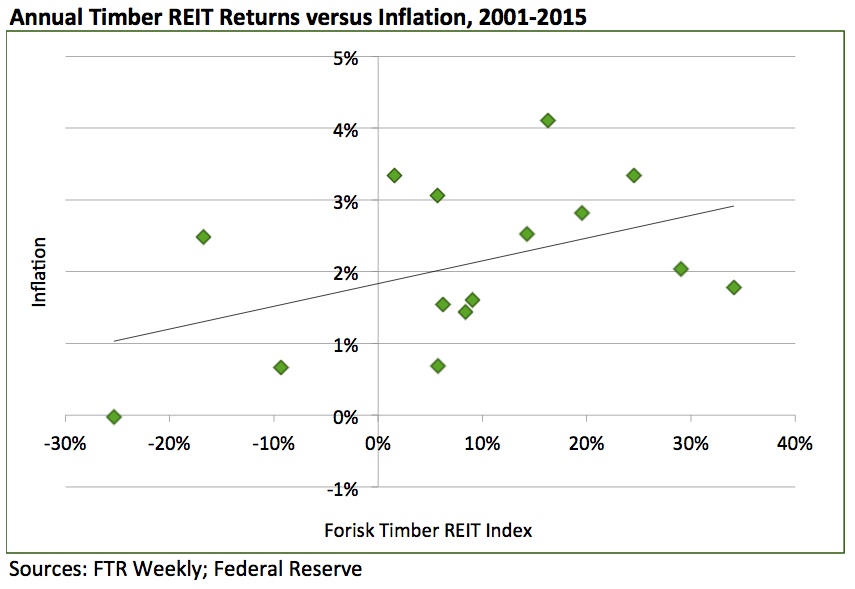

Interestingly, annual returns from the timber REIT sector have correlated positively with inflation over the past 15 years. The figure below summarizes annual returns from public timber REITs, as measured by the FTR (“footer”) Index, relative to inflation, as measured by the Consumer Price Index (CPI). Timber REITs returns, which averaged 8.2% annually since 2001 correlated positively with inflation, which averaged 2.5% over the same period (implying a real return of 5.7%, not including dividends). This type of analysis varies over time when compared with direct timberland investments, as returns from the super-liquid public equities exhibit more than twice the standard deviation of hard forestland assets.

The post includes topics addressed in the upcoming “Investing in Timberlands and Timber REITs” class on December 8, 2016 in Atlanta, Georgia. For more information, click here.

Leave a Reply