In September 2012, Forisk published analysis of timber markets across the U.S. South that estimated how excess sawtimber inventories could dampen or delay the “strengthening” of pine sawtimber and chip-n-saw prices in local timber markets. Specifically, we wrote:

“…the effect slows pine grade price growth by ~30% per year on average and reduces Base Case pine grade prices by ~$1 per ton over the next two years. This effect varies by state and local market.”

Five years of research into the relationship between forest supplies and timber prices have largely held up, with the analysis becoming more sophisticated by local market and product (e.g. sawtimber versus pulpwood). The general thinking remains consistent: too much wood can dampen price growth while too little wood can accelerate price growth.

Research in the Q4 2016 Forisk Research Quarterly (FRQ) identifies oversupply (or undersupply) situations in the South (“How Forest Supplies Affect Timber Prices in Local Timber Markets”). Forisk estimates changes in forest inventories by product and specie through ongoing research with Sub-Regional Timber Supply (SRTS) Model results generated by Dr. Bob Abt. [The SRTS model is supported by the Southern Forest Resource Assessment Consortium (SOFAC), of which Forisk is a member]. This annual exercise combines state-by-state analysis of wood demand, forest industry capacity and capital investments by Forisk with the most current forest supply data from the U.S. Forest Service. Ultimately, the analysis of timber supplies and wood demand is a spatial exercise that matches the location of wood sources to forest industry manufacturers.

In practice, timber markets have little visibility into “supply changes” outside of short-term weather events. It is hard for procurement foresters or timberland managers to “see” inventories grow or shrink at the market level. However, longer-term changes in forest inventories do influence capital investments and, as a result, prices. So while inventory-based supply changes are less relevant to short-term timber prices, they have significant implications for timber forecasts of 10 years or longer.

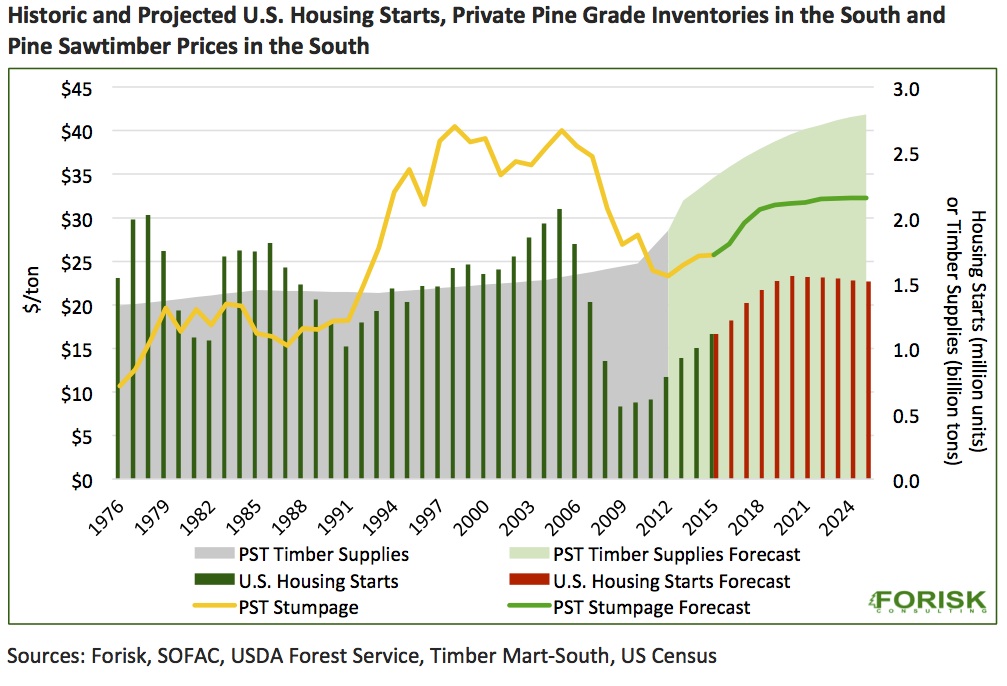

The figure summarizes 35 years of U.S. housing starts, pine grade (sawtimber and chip-n-saw) inventories on private lands in the South, and pine sawtimber stumpage prices, including 10-year projections. The key take-home is the unmistakable shift in the relative, physical relationship in raw material supplies to a core source of wood demand, and the implied economic reality flowing through to stumpage prices.

U.S. housing starts drive demand for pine grade, and the decline in housing starts during the recession (2007-2009) corresponded with increasing inventories of pine sawtimber on the stump in the South. Inventories of pine sawtimber increased for two reasons: 1) planting incentives in the 1950s and 1980s increased the acres of pine plantations and 2) the recession decreased demand for sawlogs, so landowners delayed harvesting. Even with recent demand increases, and projected increases as the U.S. moves towards 1.5 million housing starts in the next five years, pine sawtimber supplies on the stump continue to grow. The growth of forest supplies coupled with lower baseline housing starts, combine for lower overall pine grade stumpage price levels (compared with prices 10 years ago).

The post includes topics addressed in detail in the upcoming “Investing in Timberlands and Timber REITs” class on December 8, 2016 in Atlanta, Georgia. For more information, click here.

Thanks for saying that timber markets have little visibility into supply changes. If I was going to get timber I would want to make sure that I got good quality materials. I’ll need to ask a professional for assistance when I am learning about the qualities of good materials. http://www.hayters.com.au/timber