This is the first in a series related to Forisk’s Q1 2017 forest industry analysis and timber price forecasts for the United States and Canada.

Forecasts of business and market conditions support a range of capital allocation and strategic planning efforts in the timber and forest products industries. Long-term forecasts help leaders dictate the direction of an investment strategy or organization; short-term forecasts support tactical, operational decisions associated with timing, direction, and magnitude at facilities and in the field. The models we build rely on assessments of how local timber markets and wood baskets perform given sets of macroeconomic scenarios. The types of scenarios and key assumptions have as much to do with the decision to be made as with the data available, and our understanding of the forces at work.

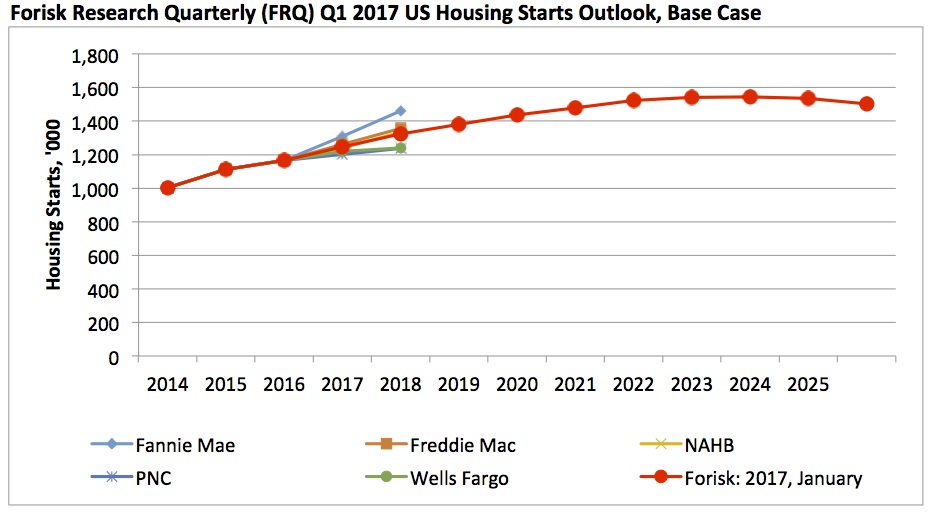

Each quarter, when updating models for the Forisk Research Quarterly (FRQ), we revisit prior projections and review applied research on business and economic forecasting. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, Freddie Mac, the National Association of Home Builders (NAHB), PNC, and Wells Fargo. Forisk applies long-term assumptions from the U.S. Energy Information Administration (EIA) in establishing the peak and trend over the next ten years (Figure).

Overall, Forisk projects 2017 housing starts of 1.25 million, up 6.8% from 2016 actuals. Forisk’s 2017 Base Case peaks at 1.54 million housing starts in 2023 before returning to a long-term trend approaching 1.50 million. For comparison, our January 2016 Base Case one year ago peaked at 1.58 million housing starts in 2020. The independent housing forecasts captured in Forisk’s Housing Starts Outlook reflect a range of expectations for 2017, with Fannie Mae on one end estimating a 12.1% growth over 2016 and PNC on the other end with a 3.1% growth estimate.

Forisk analyst Andrew Copley supported the research for this post. To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply