This is the second in a series related to Forisk’s Q1 2017 forest industry analysis and timber price forecasts for the United States and Canada.

The fact that the forest industry has changed structurally over the past 10 years is no surprise given the economic turmoil of the Great Recession. Specifically, many plywood plants shuttered, already subject to a declining end-market given competition from oriented strand board (OSB) made from cheaper, smaller logs. While sawmills closed, as well, some have re-started or retooled to become more efficient and productive. So why bring it up? Understanding how the industry has changed, especially locally for specific timber baskets, provides context for the present. It also provides critical information for company leaders to decide where to allocate capital and expand (or add) capacity.

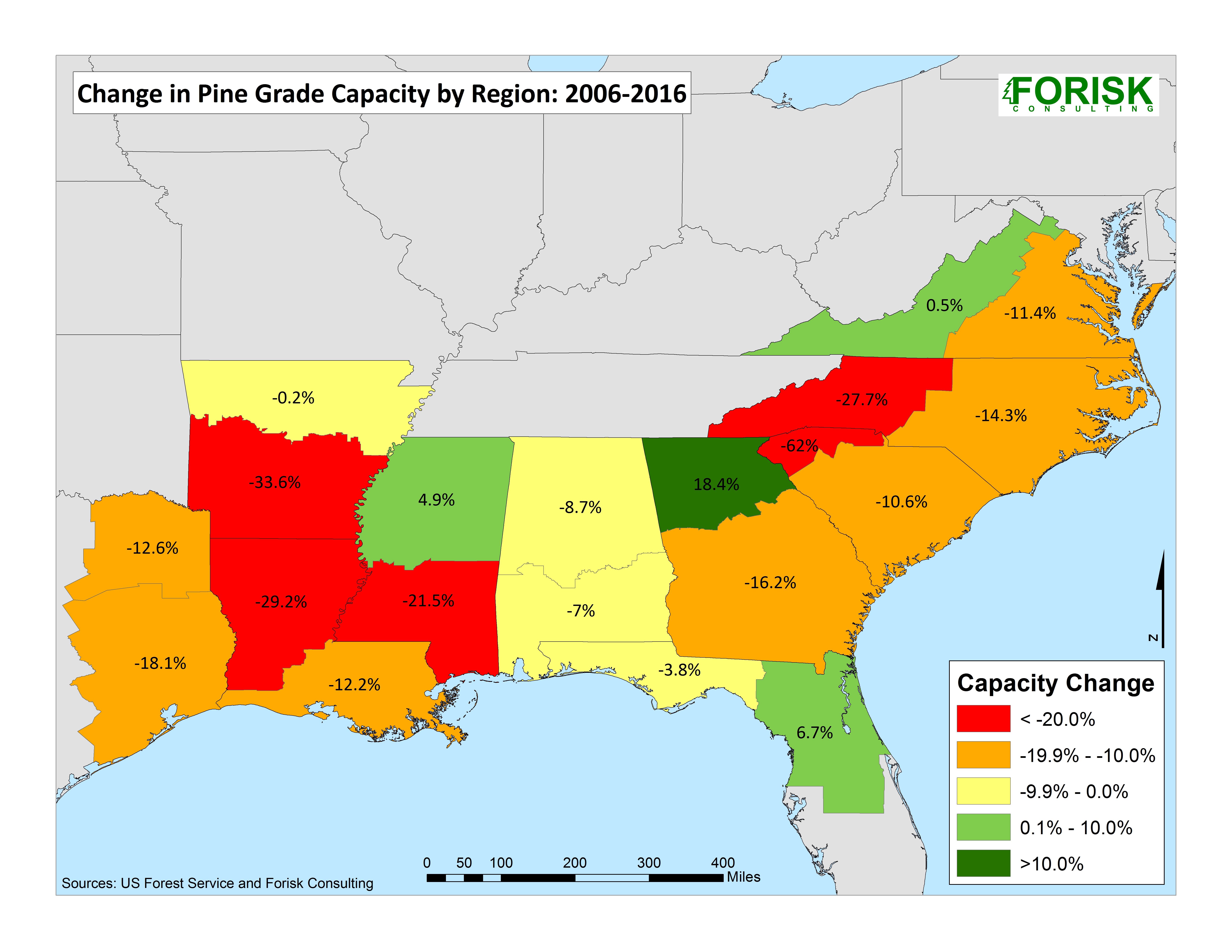

Southern pine grade capacity, including sawmills and plywood plants, declined 17% in the past ten years, but this varies by local market. The Gulf South was hit the hardest by the recession and has yet to recover (Figure). Southern Arkansas, northern Louisiana, and Southern Mississippi are still 20-35% below 2006 levels despite recent mill expansions in the area. The East Coast has fared better, with changes ranging from a 16% decline in southern Georgia to a 7% increase in northern Florida, where the Klausner Live Oak sawmill added capacity. Alabama and the panhandle of Florida stick out as areas of modest change with 4-9% declines.

Looking forward, markets in southern Arkansas, southern Mississippi, north-central Alabama, and coastal North Carolina could have more capacity increases from announced expansions, re-openings, and greenfield mills. Investments after the recession targeted the East Coast and Alabama first, starting with Canadian mill purchases and expansions. Second, investments targeted southern Arkansas. Now the newest wave of investments and activity are in the mid-South in Mississippi and Alabama (again).

Forisk Senior Analyst Justin Tyson contributed to the research in this blog post. This post includes data and analysis from “Forisk Facts & Figures” – Forisk’s quarterly “story in three slides” – a chapter in the Q1 2017 Forisk Research Quarterly (FRQ). To learn more about the FRQ, click here or call Forisk at 770.725.8447.

Leave a Reply