This is the third in a series related to Forisk’s Q1 2017 forest industry analysis and timber price forecasts for North America.

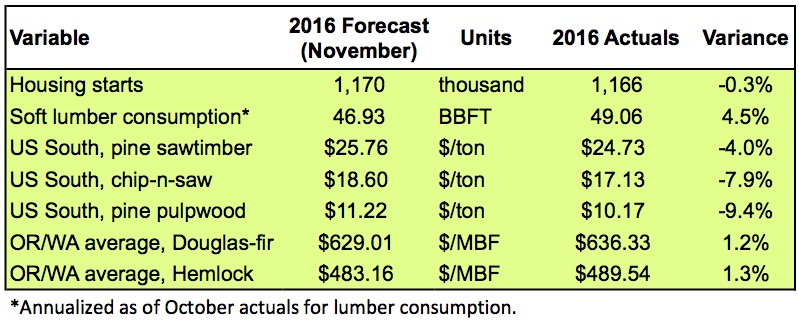

Each quarter, we look back and evaluate the performance of previous forecasts and earlier models. How did Forisk’s final 2016 forecasts track relative to 2016 actuals? Overall, year-end actuals lagged Forisk projections across the board, driven by slower-than-estimated increases in housing starts and the associated lower levels of wood demand and lumber production. Actual housing starts came in at 1.166 million, or 0.3% (4,000 units) below Forisk’s final 2016 outlook. Looking forward, Forisk projects housing starts of 1.25 million for 2017.

With respect to pine stumpage prices in the U.S. South, actual 2016 prices for sawtimber and chip-n-saw lagged Forisk’s 2016 projections by 4.0% and 7.9% each while pulpwood ended 9.4% below the 2016 forecast. Analyses of eleven individual state-by-state forecasts relative to Timber Mart-South actuals shows that Forisk’s projections were, on average, $0.60 per ton higher, $0.73 per ton higher, and $0.43 per ton higher than the actual pine sawtimber, chip-n-saw and pine pulpwood prices respectively for 2016.

Forisk Scorecard: Forecast versus 2016 Actuals

For the Pacific Northwest, delivered softwood prices reported by Wood Resources International and the Oregon Department of Forestry were 1.2% higher than Forisk final 2016 projections for domestic #2 delivered Douglas-fir along the Oregon/Washington coast, and 1.3% higher for domestic #2 delivered hemlock logs for the same region. Across categories in Oregon and Washington, Forisk projections tracked $6.85 per MBF below 2016 actuals for domestic logs.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Kudos to the Forisk team for having the courage to publish a variance analysis. As my favorite professor once quoted a consultant, “to err is human, to err and be paid, divine.” Keep up the great work.

Thank you, Tom!