This is the fourth in a series of excerpts from Forisk’s Q1 2017 forest industry analysis and timber price forecasts for North America.

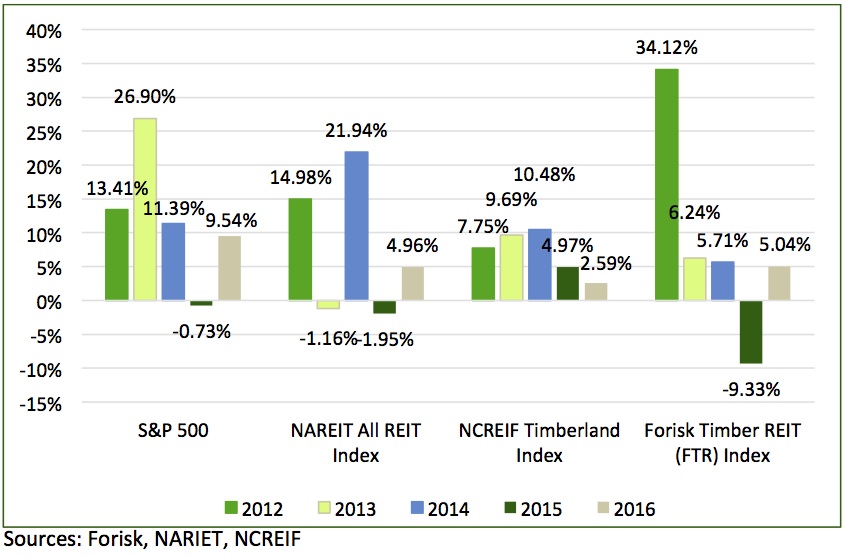

All equity indices tracked by Forisk – timberland and otherwise – produced positive returns in 2016; only private timberlands generated positive returns for each of the past five years. Figure 1 compares 2012 through 2016 annual performance of indices tracking the S&P 500, all publicly traded real estate investment trusts (NAREIT), private timberlands (NCREIF), and public timber REITs (FTR). Overall, public timber REITs returned 5% as a group in 2016 and 6% since the U.S. Elections in November 2016. And for 2016 and thru January 2017, there have been 9.3 million acres of announced, completed U.S. timberland transactions and another 2.3 million acres of pending transactions.

Figure 1: Timber Investment Indices Relative to Other Assets, 2012-2016

The U.S. Presidential Election has generated ongoing questions and speculation regarding implications for timberland investors and forest industry firms. In response to these questions, Forisk focuses on what we can measure: the performance of public timberland-owning REITs and other public timberland owners not structured as REITs (Pope Resources and Deltic) relative to key benchmarks since the Election in November 2016. Through January 2017, all four public timber REITs trailed the S&P 500, while three of four individual firms had positive returns. Deltic Timber (DEL) and Pope Resources (POPE) leaped 33% and 26% respectively in the three months since the Election.

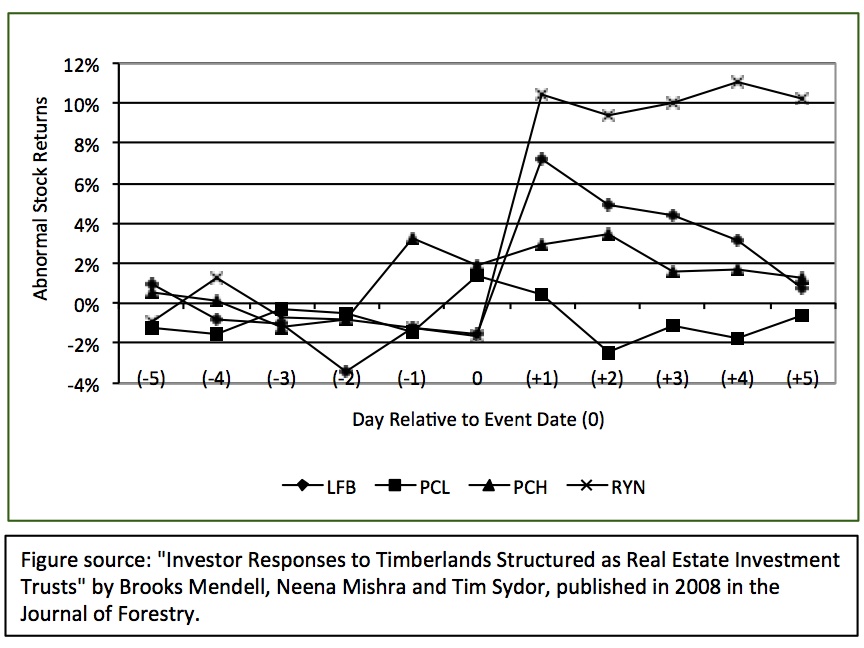

Forisk Flashback: research we completed over ten years ago and published in 2008 analyzed stock market responses to four announcements of forest industry corporations converting their structures from traditional C-corporations to real estate investment trusts (REITs). These announcements were Plum Creek in 1998, Rayonier in 2003, Potlatch in 2005, and Longview Fiber in 2005. All four announcements were associated with significant abnormal increases in the stock prices of the four firms on the day before, day of, or day after each firm’s announced REIT conversion (Figure 2). This “flashback” provides an opportunity to recap the reasons why firms find the REIT structure attractive for real estate generally and timberlands specifically.

Figure 2: Cumulative Returns by Day for Firms Becoming Public Timber REITs

Link to the original article here.

Two of the most attractive REIT characteristics are their liquidity and tax efficiency. For publicly-traded stocks, shares in these firms are easily bought and sold on a daily basis, while direct buying and selling of timberlands typically require longer time frames, higher administrative costs and more starting capital. Also, as REITs, these firms effectively pay no corporate income tax on earnings from timber activities, with taxes paid by shareholders on dividends. This provides REITs with a clear advantage over C-corporations while mirroring the tax efficiency of ownership structures used by family and individual investors.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Figure 1 is one of the most difficult to understand charts I have seen. I think it would be much more intuitive if the X axis was the years 2012-2016 and the colored bars reflected the yearly return of the various indexes. Then the yearly return of the indexes relative to each other would be clear.

Les: good point, and greatly appreciate the suggestion. We will modify this moving forward.

5-year Ncrief returns demonstrate the best return to risk ratio; with 5-year CAR of 7.05% and std dev. of 3.3%. FTR is considerably more variable and has the lowest return to risk ratio with a 5-year CAR of 7.55% and Std dev of 15.78%. Return to risk ratios for the S&P and Nariet are intermediate.

It is interesting to note that market has priced in expected corporate tax cuts. These should benefit Deltic Timber more than the Timber Reits, hence the difference in price bump; It is not clear to me why Pope given it is an MLP, has also experienced a large bump too.