Albert Einstein, the smartest guy most of us never met, said, “The hardest thing in the world to understand is the income tax.” [Fascinatingly, this quote, along with others, can be found on the IRS website here.]

Taxes matter in forestry, affecting most business decisions by for-profit firms and individuals. Ultimately, forest investors care about after-tax cash flows and values. Once income is withheld or designated for taxes, it is no longer available for consumption or investment. Forestland owners and timberland investors are subject to local and federal taxes, and these taxes differ by state and county (and country).

Federal taxes classify income into two categories: capital gains and ordinary income. Capital gains are profits on the sale of capital assets (such as real estate). Ordinary income is that which does not qualify as capital gains.

From an investor standpoint, capital gains income has more value than ordinary income because it results in larger, available after-tax cash flows. Why? Because long-term capital gains are taxed at lower rates than ordinary income. So your after-tax cash flows from capital gains are higher; you have more “residual” cash flows available for reinvestment or baseball cards. How does this work in forestry?

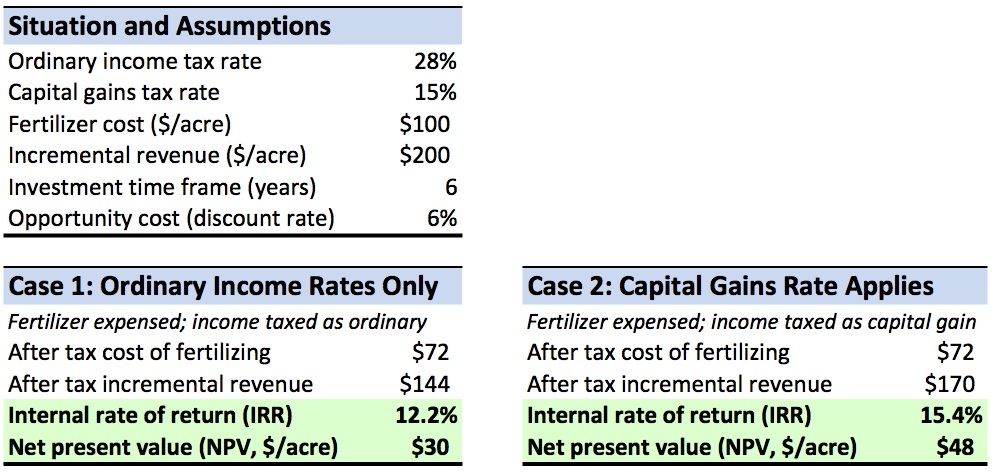

Consider the following simplified situation:

- You spent $100 per acre fertilizing your forest.

- You expect to generate $200 of incremental income per acre from this fertilization in six (6) years.

- Your marginal ordinary income tax rate is 28% and your long-term capital gains rate (which can apply to timber income) is 15%.

What are the implications from an investment and returns perspective from these taxes as applied? Compare the implied returns from the “ordinary income” situation (Case 1) to the case where different rates apply when expensing costs versus taxing income (Case 2); the ability to apply capital gains rates to timber income enhances returns and net cash flows.

Forestry is not a high margin business. So every dollar we preserve by properly applying the tax code matters.

Click here to learn about and register for “Applied Forest Finance” on March 30th in Atlanta, Georgia. The course includes a review of key tax topics, including depletion and 1031 like-kind exchanges.

Leave a Reply