This is the fourth in a series related to Forisk’s Q2 2017 forest industry analysis and timber price forecasts for the United States.

From 2009 through 2016, U.S. housing starts increased 112%, a compound annual rate exceeding 11%. Over this same time, U.S. softwood lumber consumption increased 55% and average annual pine sawtimber prices in the U.S. South…wait for it…declined 10%. Housing is up! Lumber use is up! But prices are down? This apparent disconnect between housing and stumpage prices tops the list for reasons why our shoe phone rings. And yet, this story has clear antecedents, which lay the groundwork for assessing future timber prices in the U.S. South.

Each quarter, we back-test and update timber price models to evaluate local timber markets and wood baskets across the U.S. Here are six key factors affecting the responsiveness of timber prices to changes in demand:

- Substitution. Southern lumber markets are subject to two forms of substitution in the near-term. First, homebuilders in the South can substitute lumber from Canada or the U.S. West for sticks sawed in the South. While the Southern production growth rate outpaced imports from 2010 through 2012, imports outpaced Southern production from 2013 through 2016. This trend is shifting back, we note. Second, we shift and substitute end uses. During the recession, we built fewer homes and did more remodeling and repaired the homes we had. In 2010, repair and remodeling (R&R) accounted for 29% of U.S. softwood lumber applications, exceeding the 26% for new construction. In 2016, new construction accounted for 37% of softwood lumber applications, while R&R declined to 26%. So builders and consumers adjust and move, at times, the same lumber from one project to another. In short, building new homes does not secure a one-for-one increase in lumber production or consumption.

- Technology. Technology improvements affect both sides of the forest industry equation. We grow wood better and faster than ever. Our ongoing research into forest management practices in the U.S. confirms highly active, intensive, effective forest management. So we’re growing more wood than ever. At the same time, yields at industrial softwood sawmills – those producing 100+ million board feet per year – have improved nearly 20%. In addition, other process improvements for better drying (CDKs) and scanning indicate U.S. sawmills in the South will blow through their historic production records by 2019 and use less wood doing it. With the closing of the weakest mills over the past twenty years, today’s “average” sawmill gets closer to NASCAR than used car.

- Supplies. We have been studying and quantifying the supply “overhang” in the South since 2012. Our original analysis estimated that excess supplies slow pine grade price growth by ~30% per year on average. We also assumed that this effect applied to ~60% of the timber markets as Forisk analysis indicates that, South-wide, about 60% of timbered areas sit within operable wood baskets. However, the math of the slow recovery swamps that assumption. This quarter, Forisk removed the 60% assumption because our sawtimber models consistently over-projected “next-year” stumpage prices. This change lowered the South-wide average forecast by $0.58 per ton for pine sawtimber. Three drivers suggest higher levels of accumulated inventory than previously estimated:

- Forest growth rates: borrowing the math of compound interest, a forest with net growth of 3% could double in 24 years, while a forest with net growth of 4% could double in 18 years. Advances in silviculture and forest management indicate we have made small improvements each and every year in the South for the past 50 years. And these effects would be compounded by…

- Harvest patterns: during the housing boom in the 1990s and early 2000s, the pine sawtimber harvests actually exceeded net growth for a period of time. This is normal. However, the timing affects supplies today. Increased clear-cutting led to increased planting which primed the pump for additional pine grade volumes to grow and accumulate today and tomorrow.

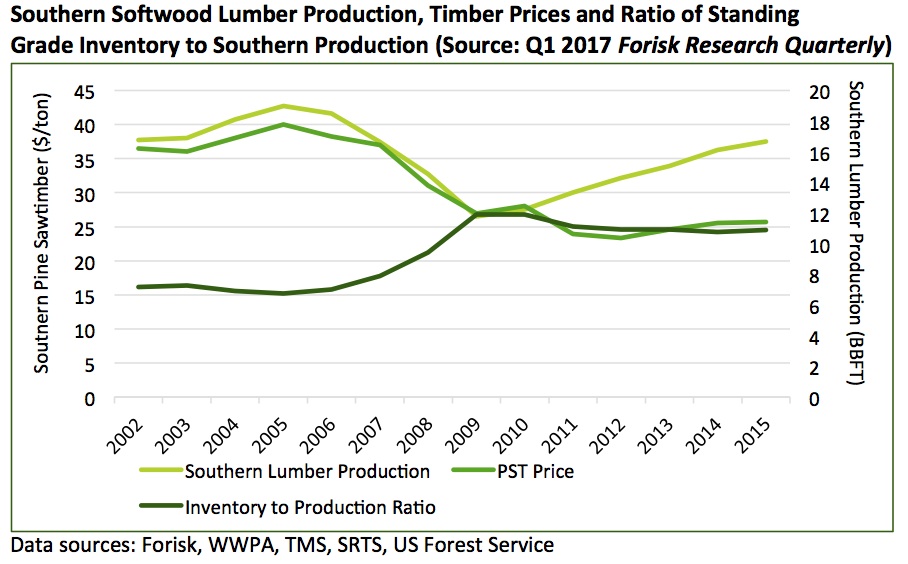

- Sawmill yields: revisiting technology reminds us that improved efficiency increases forest supplies on a “relative” basis, as well. And these improvements, like growth rates, compound. If we grow more at a faster rate, and use less at an improving rate, then the spread between growth and removals can expand. We summarized this reality in tracking the relationship between prices, production and sawtimber inventories over time in the South. Prices remain flat as the ratio of inventories and production remains constant. In short, the forest is growing with production; tree growth has kept pace or led softwood lumber volumes to date.

- Utilization. Regardless the handwringing, we remain at relatively low levels of demand. Softwood lumber production in the South JUST returned to 2003 levels in 2016. The South peaked at 19 billion board feet in 2005, which Forisk projects for the South again by 2018/19. Since the recession, the forest industry recapitalized the South with more efficient, higher volume mills on average, while housing remains ~20% below the long-term expected trend. So meaningful upside remains. We are just getting the demand flows and utilization rates that start to tighten the string.

- Anxious sellers. Forest owners sell timber for a range of reasons. And a period of lower prices and delayed harvests can create anxiety or a compelling need to sell trees. [In our forest finance workshops, the most popular case studies over the past five years have been those associated with the “marginal harvest decision”; should we harvest now or wait for prices to rise?] Overall, we observe ready sellers and ideal, dry harvest conditions can combine to dampen timber prices. This is especially true in a well-supplied region that, unlike the Pacific Northwest, lacks a robust, string-tightening log export market.

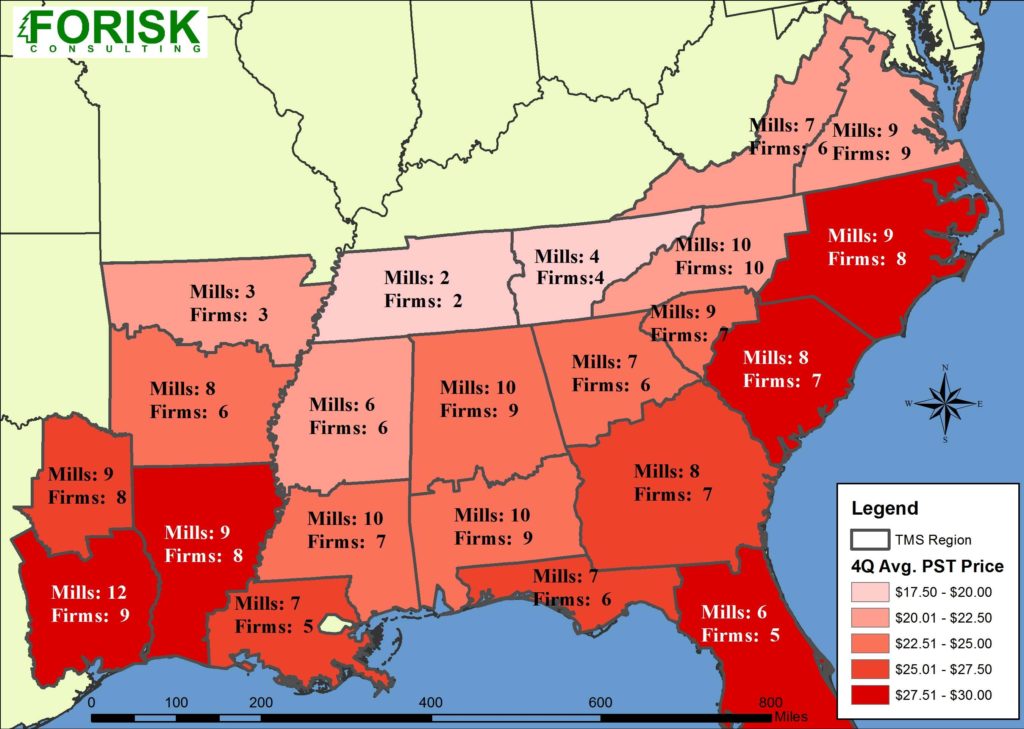

- Disciplined buyers. At the moment, softwood lumber margins in the South are the highest of all North American regions, thanks to cheap logs, efficient logging systems and lower cost labor. Sawmill operators have been reallocating capital and production to the South for over ten years, anticipating the strategic benefits of the region for long-term profits and sustainability. We track the relative competitiveness of markets, including the concentration of mills to firms, and find that, to date, higher prices still flow to markets with higher levels of demand closer to end markets (see map). However, thanks to the combined factors detailed above, disciplined firms recognize the current situation as a clear, buyer’s market.

Last Four Quarter Average PST Price and Average Number of Mills and Firms Competing for PST by County by TMS Region (Source: Q2 2017 Forisk Research Quarterly)

To learn more about the Forisk Research Quarterly (FRQ), or to schedule Brooks Mendell for a presentation at your firm or event, contact Heather Clark at hclark@forisk.com or 770.725.8447.

Leave a Reply