Below is an excerpt from a Q3 2017 article in the Forisk Research Quarterly examining issues affecting commercial automobile insurance and log truck insurance specifically.

Large swaths of the general public still have no idea what modern logging entails. Even in areas with extensive forest industry activity, many people associate the chainsaw as the state of the art and it’s alarming how many people still ask about livestock extracting the logs. However, one thing almost everyone associates with logging is trucks. Stacked, cut logs traveling down the highway may be the most visible and recognizable aspect of the forest industry. At some point, a truck transported from the forest every forest product in use today. A functioning wood supply chain requires log trucks. Yet, the viability of log hauling challenges the entire chain. Hauling is a low profit margin operation. It is highly regulated and, in part because of its visibility, subject to frequent inspections. Increasingly, it also feels pressure from insurance markets with costs reportedly rising and availability falling.

Discussions of log truck insurance have increased at industry association meetings over the past few years as loggers raised concerns about insurance costs. To clarify our understanding of the issue, Forisk reached out to a number of people involved at all levels of trucking insurance. We spoke with logging contractors from seven states spread across the U.S., representing around 350 logging trucks. They repeated the same issues. Almost all employed drivers who had been denied coverage by an insurance company. It is increasingly difficult to cover a driver. Typically, they need two years of driving experience after gaining their commercial driver’s license (CDL). They must pass drug and alcohol tests to maintain their CDL. Often, they must also have a safe driving record. The standard for coverage denial was anything more severe than a single, minor traffic violation. Multiple violations or any “serious” violation, such as speeding more than 15 mph above the speed limit, invalidated a driver.

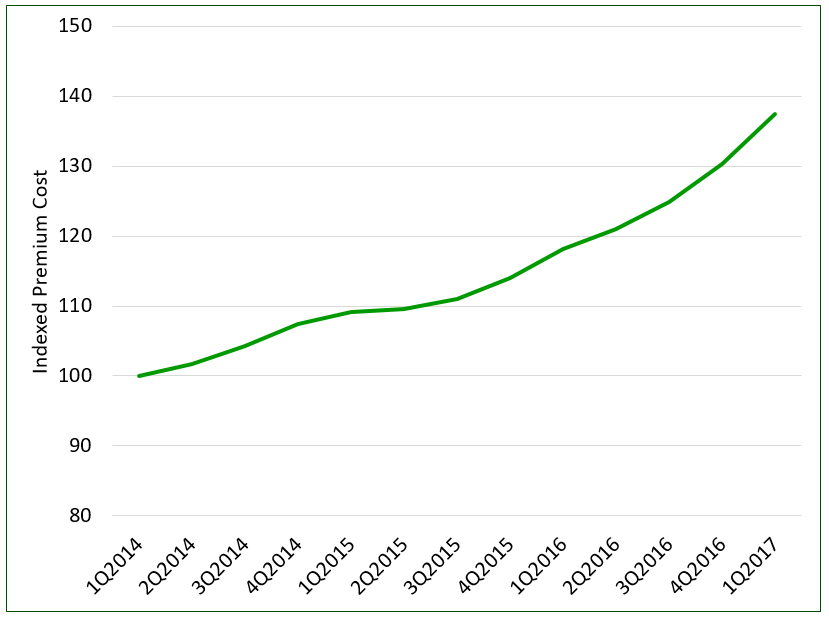

Given the strict standards, it is not surprising loggers might move between insurance companies. All but one logger we spoke with had changed providers over the past three years. The reason for switching companies was relatively evenly split, with half seeking lower rates and the other half switching because their current insurer left the state. That is a worrisome trend, though almost all of the loggers reported having multiple companies still willing to write them a policy. Insurance premium increases had affected all but one company (a large company with both in-woods and over-the-road trucks). Premium increases ranged from 10% to 300% over the past three years based on the claims history of each company and their success in pursuing lower rate providers.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

[…] (Continue reading…) […]