This post includes an excerpt from research published in the Q4 2017 Forisk Research Quarterly (FRQ).

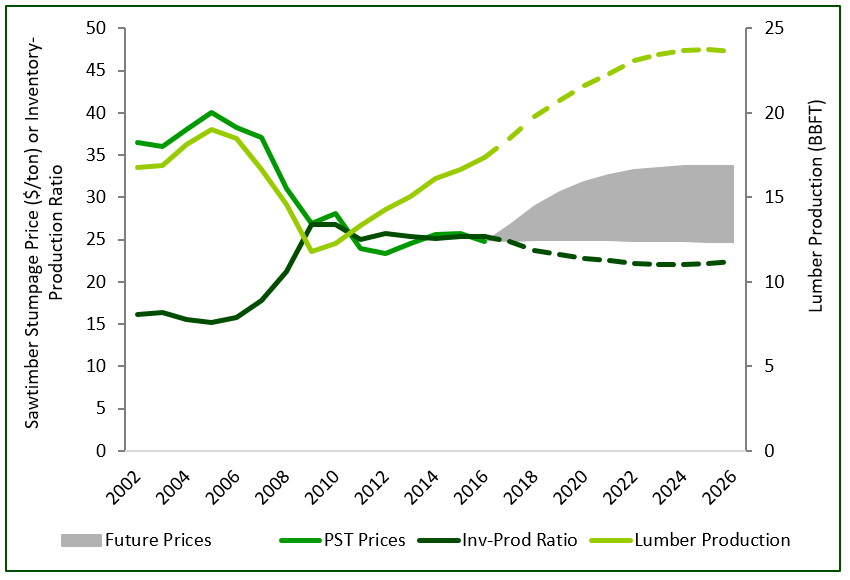

The post-recession U.S. South currently features unresponsive timber prices, despite increases in housing and lumber production. While trends associated with industry consolidation and efficiency play a role, accumulating pine timber supplies on the stump drive this story. The forest profile in the South changed during and following the recession. Sawtimber inventories grew from the equivalent of 15 years of removals on the stump (relative to annual demand) to over 25 years of removals on the stump (Figure). The average forest in the South today still has 20 years of standing inventory. The recession reset the “normal” relationship of supplies to removals in the South; we estimate a new baseline with 5 more years of inventory relative to removals.

Prior to the recession, sawtimber prices responded directly to demand shifts. However, over the past six years increasing lumber production and wood demand barely moved prices. Have supplies overwhelmed demand? If so, when will sawtimber demand be significant enough to affect prices? Combining our lumber forecast with an outlook on future supply, the ratio of inventory to demand will not dip below 20 over the next ten years. If prices once again become more responsive to demand, price growth could accelerate over that timeframe. However, if supplies swamp demand, as we’ve seen over the past few years, prices could remain lethargic.

Forisk estimates changes in forest inventories by product and specie through ongoing research with the Sub-Regional Timber Supply (SRTS) Model results generated by Dr. Bob Abt at N.C. State and supported by the Southern Forest Resource Assessment Consortium (SOFAC). This annual exercise combines state-by-state analysis of wood demand, forest industry capacity and capital investments by Forisk with current forest supply data from the U.S. Forest Service. Ultimately, the analysis of timber supplies and wood demand is a spatial exercise that matches the location of wood sources to forest industry manufacturers. In applying this to timber price forecasts, we also look for other evidence and clues on how changes in supply could affect prices. Previous research into elasticities and natural disasters inform our understanding for improved price projections.

This article, co-authored by Amanda Lang and Brooks Mendell, summarizes our updated supply forecasts for pine pulpwood and sawtimber in the U.S. South and discusses price implications. The research supports Forisk’s forest industry scenarios and timber market models. To learn more, please click here or call Forisk at 770.725.8447.

Leave a Reply