This is the fifth in a series related to Forisk’s Q4 2017 forest industry analysis and timber price forecasts for North America.

Institutional Investor recently published a bizarre article claiming that timberland investments are well positioned for a “comeback.” Comeback from what? Merriam-Webster defines a comeback as “a return to a former good position” and “a new effort to win…after being close to defeat…” While timber prices struggle due in part to excess timber supplies, timberland investment vehicles themselves have performed well, thank you very much, both in absolute and relative terms.

Consider public timberland owning firms. Per the Forisk Timber REIT (FTR) Index, public timber REITs returned 18% YTD through the final Friday of October. Potlatch (PCH), which currently comprises 6% of the timber REIT sector, led the way with 24.4% while also announcing a deal to combine with Deltic Timber. Three timberland-owning firms outpaced the S&P 500 through the first ten months of 2017: Potlatch, Deltic, and Weyerhaeuser (WY).

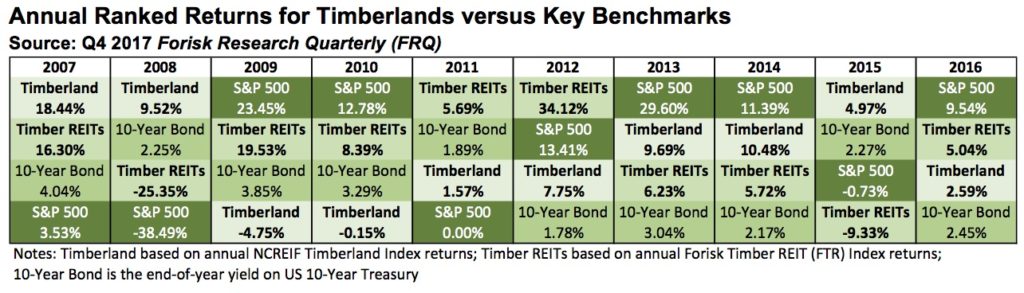

Investing is as much about making choices among available alternatives over time, as it is anything. Strong investments outperform benchmarks; they simply outrun the pack, even if just sliding first among a hood of snails. So articles that ignore data or relative historical performance fail to provide context. Timberland has done fine. If anything, timberland remains attractive on its own terms. Look at how timberland performed by year relative to other asset classes (see figure). Regardless the expectations and promises, timberland strengthened and diversified portfolios.

A 2017 upswing in timberland transactions, and the increasing volume of due diligence activities, also provides an opportunity to revisit the math of the sector. When we ask whether timberland is poised for resurgence or a Rocky-like comeback, we must look to its relative performance versus other asset classes. The year-by-year performance of timberland and other assets speaks to its durability as part of portfolio resilience. Timberland, like other assets, move up and down over time, depending on everything else going on in the world.

Let us conduct analysis with both feet on the ground. A mountain of algebraic equations or econometric models can actually do more to hide the truth than remind us that we should treat market sentiment with skepticism. Check the data, provide context, and consider the reality that relationships between prices and local markets respond both to knowable physical facts on the ground and elusive exogenous events in the macro economy.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447. The topics and data referenced in this post will also be covered at the one-day “Wood Flows and Cash Flows” investor event on December 7th in Atlanta.

Nice to see someone address that article. The author didn’t even understand the difference in timber and lumber.