This is the sixth in a series related to Forisk’s Q4 2017 forest industry analysis and timber price forecasts for North America.

The pulp/paper industry in the U.S. continues to shift away from newsprint and printing papers in favor of packaging and commodity products. While these trends project a slight decline in total paper and board production in the next five years, regional implications for timber and manufacturing investors vary. Local mill capacity and end-use exposure distinguish timber markets.

Total paper and paperboard production grew 2.4% Q3 2017 buoyed by increases in packaging products (2.6%) and printing/writing (4.1%). According to AF&PA, newsprint and printing/writing sectors continue to decline in the U.S. on an annual basis, although printing/writing production was up for Q3 2017. Tissue production was flat in Q3 while up almost 1% for the year.

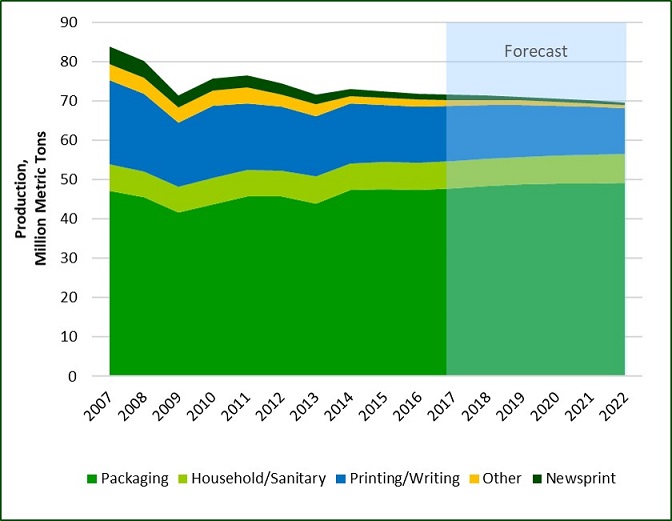

Forisk’s updated forecast of U.S. paper and paperboard projects a 3% decline in production for the next five years. Newsprint and printing and writing decline while packaging and household/sanitary products increase (Figure 1). Updated projections forecast slightly lower production levels of U.S. paper and paperboard than our 2016 outlook. The packaging forecast is lower than last year as production declined in 2016. Alternatively, printing/writing declined less than we expected in 2016, which contributes to higher (but still declining) production levels for the next six years. Forecasted growth in the paper sector varies regionally with exposure to end markets; the South benefits from packaging while the North declines with printing and writing. Despite a declining forecast for the North, declines could be less severe than forecasted as some mills could convert from producing printing and writing papers to growth sectors such as packaging or household products.

Investments in the sector mirror the production forecasts; pulp/paper firms invested at least $5 billion in the past five years, with 40% in household/sanitary facilities and 53% in packaging, based on public announcements. Announced investments in 2017 total at least $1.4 billion for the paper sector, with the most capital allocated to the packaging and household/sanitary sectors. Top investments for 2017 include GP’s investments at Brewton, AL, Resolute’s tissue machine in Calhoun, TN, and Clearwater Paper’s upgrades in Lewiston, ID. Resolute FP also shut down newsprint operations at Calhoun, TN in Q3 2017 to focus on tissue production. In addition, Graphic Packaging agreed to purchase International Paper’s North America consumer packaging business, a transaction valued at $1.8 billion. The business includes two paperboard mills in Augusta, GA and Texarkana, TX, along with four converting facilities.

Forisk thanks Dr. Jack Lutz with Forest Research Group for his assistance with this research.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447. The topics and data referenced in this post will also be covered at the one-day “Wood Flows and Cash Flows” investor event on December 7th in Atlanta.

Leave a Reply